How do you determine and locate high-integrity carbon credits? Here, in the first of our four-part corporate buyers article series, we break down the main integrity initiatives in the voluntary carbon market today, and how to use them and other tools to find the right high-quality carbon credits for your needs.

Despite many headlines suggesting the reverse, the vast majority of businesses globally are continuing to strengthen their climate commitments, and, in tandem, several initiatives are underway to increase the integrity of the voluntary carbon market (VCM). These moves are further strengthening the VCM so that buyers can be confident that the tonnes of CO2 they are purchasing correspond to a real, measurable, and lasting climate benefit.

But with multiple systems, standards, and criteria to navigate, it’s not always obvious where to begin. To help find and evaluate high-quality carbon credits, this article lays out the current landscape of integrity benchmarks and shares practical steps for buyers.

What does integrity in carbon markets mean?

Integrity in carbon markets relates to whether a carbon credit represents a real and additional tonne of CO2 avoided or removed from the atmosphere. High-integrity carbon credits are:

- Verified by an independent body;

- Additional, meaning the reduction wouldn’t have happened without carbon finance;

- Permanent, so the CO2 stays locked out of the atmosphere;

- Free from double-counting, with no other entity claiming the same climate mitigation;

- Transparent, with clear project information and methodology use; and

- Scientifically aligned, working as part of a wider net-zero or climate strategy.

Ensuring the integrity of a carbon credit reassures carbon credit buyers that it genuinely makes a difference, whether that’s to offset emissions, support nature, or meet regulatory requirements, and would stand up to scrutiny if their claim were ever challenged.

Why is integrity important?

Integrity isn’t just a technical requirement; it’s the foundation for trust and long-term participation in carbon markets.

High-integrity carbon credits give companies and investors increased confidence to use the VCM as part of credible, science-aligned climate strategies. When buyers trust that a credit reflects a real climate benefit, they’re more likely to participate, and therefore to also invest at scale.

That trust can translate into real impact. Integrity ensures that carbon finance flows to projects that genuinely reduce or remove emissions, not just those that look good on paper. It helps direct funding to the places and solutions where it can make the biggest difference, supporting broader progress towards global net-zero goals while providing other benefits like ecosystem protection.

It also signals climate leadership. Companies that prioritise credit quality aren’t just offsetting emissions; they’re taking ownership of their environmental footprint and supporting the development of high-impact climate solutions.

As regulatory expectations grow, integrity also becomes a form of future-proofing. Organisations that focus on quality today are better placed to manage reputational, legal and financial risks tomorrow.

Ultimately, widespread confidence in credit quality is what allows carbon markets to scale. High-integrity carbon credits lay the groundwork for a thriving, high-functioning market, one capable of channelling more finance into the solutions needed to avoid dangerous climate change.

What are the new benchmarks for integrity in the VCM?

Three key initiatives have recently emerged to raise the quality bar across carbon markets.

The Integrity Council for the Voluntary Carbon Market (ICVCM)’s Core Carbon Principles (CCPs)

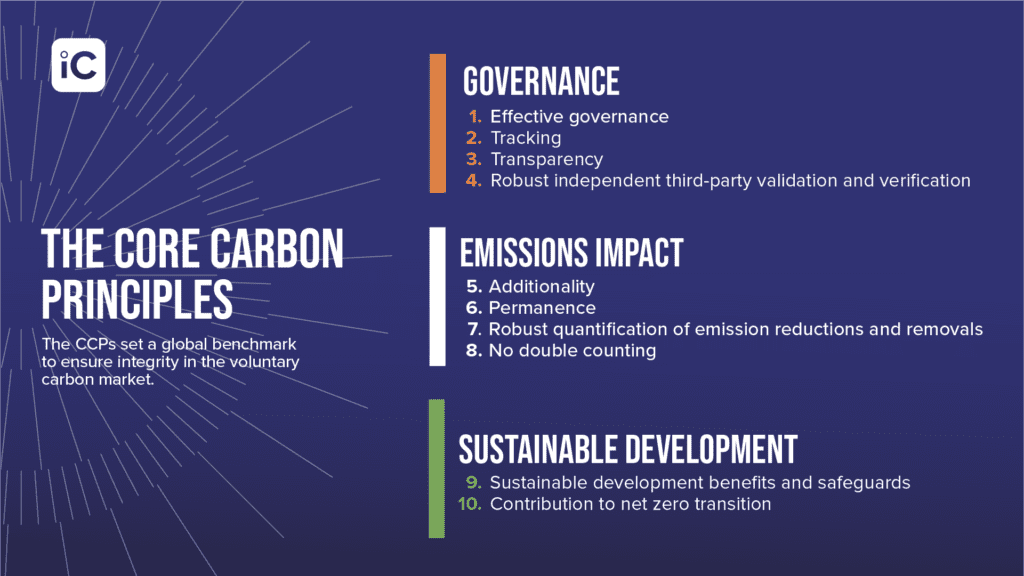

The ICVCM’s CCPs set a global benchmark for high-integrity carbon credits. They require strict standards for environmental integrity, quantification, and governance.

These 10 science-based principles define a threshold for environmental integrity, robust quantification, and sound governance, ensuring that only credits delivering real and verifiable climate impact receive the CCP label.

The ICVCM’s Core Carbon Principles. Source: ICVCM

CCPs apply to both the underlying standard, such as Verra or Gold Standard, and the specific methodologies used by project developers to create high-integrity carbon credits.

ICVCM has been systematically assessing methodologies by project type, for example recently announcing which afforestation, reforestation and revegetation methodologies are now CCP-approved.

A CCP-label represents a high bar – according to Abatable analysis, only around 6.4% of credits issued in the market today are ultimately likely to receive a CCP label.

Read more about the Core Carbon Principles in the Abatable platform.

Carbon Offsetting and Reduction Scheme for International Aviation (CORSIA)

CORSIA was established in 2016 to help keep net CO2 emissions from international aviation at 2019 levels. Since 2019, under the scheme, airlines are required to report their annual CO2 emissions and, beginning with CORSIA’s First Phase, they have been obliged to offset any growth in emissions above 85% of 2019 levels. This becomes mandatory in CORSIA’s Second Phase starting in 2027.

Importantly, CORSIA is not intended to replace efforts to reduce aviation emissions through advances in technology, operations, infrastructure, or the increased use of sustainable aviation fuel. Rather, it complements these initiatives.

The scheme, developed by the International Civil Aviation Organization (ICAO), requires airlines to use only high-quality credits that meet strict criteria for additionality, permanence, and transparency. These are only from certain registries, and credits have to have a ‘Corresponding Adjustment’ to ensure they won’t be double-counted by countries looking to trade carbon credits under Article 6 of the Paris Agreement.

By mandating robust reporting and offsetting standards, CORSIA gives buyers confidence that each credit represents a real, measurable reduction or removal of CO2, while helping to raise quality expectations across the wider carbon market.

Read more about CORSIA on the Abatable platform.

Paris Agreement Article 6.4

Article 6.4 of the Paris Agreement establishes a centralised UN crediting mechanism with some of the highest integrity standards in the carbon market. Overseen by a dedicated supervisory body, credits in the Article 6.4 ‘Paris Agreement Crediting Mechanism’ need to meet strict additionality, baseline, and safeguard criteria, ensuring they represent genuine, verifiable emissions reductions or removals.

There are a number of standards under Article 6.4 that credits have to satisfy:

- Additionality standard – to demonstrate the emissions reduction activity wouldn’t have occurred without Article 6.4 incentives;

- Methodologies standard – which provides the technical framework for how emissions reductions and removals are quantified and credited;

- Removals standard – which provides the technical framework for how emissions reductions and removals are quantified and credited;

- Baseline standard – which determines reference scenarios against which emissions reductions and removals are measured; and

- Leakage standard – for identifying and addressing emissions that shift outside project boundaries.

Both government and corporate buyers can source these carbon credits that are approved by the UN from the Article 6.4 standard and registry. Governments can source credits with Corresponding Adjustments, meaning the emissions reduction or removal can be transferred from the host country to the buyer country via UNFCCC national carbon accounting to enable buyer countries to reach their emission reduction targets.

Companies do not need these Corresponding Adjustments because they do not report emissions to the UNFCCC, but Article 6.4 presents another option for companies to source credible, quality credits.

Read more about Article 6.4 on the Abatable platform.

Do these benchmarks cover everything?

These initiatives are powerful filters, but they don’t capture every high-quality project, particularly those in newer or smaller-scale methodologies that haven’t yet been assessed or approved.

For example, some developers working in innovative or underfunded areas (such as mangrove restoration or clean cooking) may not yet have credits labelled under CCP or CORSIA, but still meet, or even exceed, key quality benchmarks.

As we explored in our recent webinar, High stakes, higher integrity, navigating this complexity requires a nuanced approach. Relying solely on labels may cause buyers to overlook impactful projects that haven’t yet passed through these new systems.

How can you find high-integrity carbon credits?

You can start by checking whether a credit carries a CCP label, is CORSIA-eligible, or is being positioned for Article 6.4 transition. But this often means trawling through multiple registries, methodologies, and issuances manually.

That’s where technology and expertise come in handy. Abatable’s platform allows filtering by project integrity initiative, and our expert team continuously monitors emerging approvals, helping carbon credit buyers stay ahead of eligibility changes by supporting them through any or every stage of their carbon credit journey.

This insight can pay dividends. As highlighted in our Decoding the VCM in 2024 and beyond report, smaller or lesser-known developers have a larger share of high-integrity carbon credits. Expert advice can help find these hidden gem credits that combine impact, integrity, and innovation.

Building a robust due diligence process

Labels and schemes are a strong starting point for finding high-integrity carbon credits, but they’re not a substitute for a rigorous evaluation process.

Once potential credits are shortlisted, a structured due diligence framework can help ensure integrity while balancing cost, risk, and impact when deciding on a final carbon credit portfolio. This might include:

- Reviewing project documentation and independent verification;

- Assessing alignment with internal climate targets or procurement policies;

- Evaluating co-benefits (e.g. biodiversity, community development); and

- Cross-checking against integrity frameworks, such as Abatable’s quality framework.

Whether you’re offsetting, investing, or supporting insetting strategies, a clear assessment process ensures you’re not just buying carbon credits, you’re buying credible climate outcomes that you can trust are making a difference.

Getting started

The integrity landscape is maturing fast, but it’s still fragmented. Buyers today face both opportunity and risk in navigating this evolving market.

At Abatable, we help organisations identify, assess, and procure high-integrity credits through our platform and end-to-end advisory services. From sourcing CCP-approved credits to evaluating emerging methodologies, we bring transparency, context, and confidence to your climate investments.

Get in touch to find out how we can help you find and procure high-integrity carbon credits.

Read the other articles in our corporate buyers series:

- How to run an RFQ to access high-quality carbon credits, faster

- How to approach carbon credit claims confidently in a rapidly evolving market

- How to talk to your CFO about your carbon budget

Finally, read more on how leading carbon credit buyers approach the market in our latest report, What leading carbon credit buyers do differently.