Abatable’s Head of Origination and Structuring, Irina Fedorenko, was at the World Economic Forum’s 55th Annual Meeting at Davos-Klosters, contributing to the climate and carbon discourse. Here are her main takeaways from the event.

Around 3,000 policymakers, business leaders, civil society representatives, academics and entrepreneurs converged in Davos last week for discussions at the World Economic Forum (WEF) Annual Meeting, centred around the theme ‘Collaboration for the Intelligent Age’.

A staple of the annual event is the publication of WEF’s Global Risks Report, which has regularly included climate-related risks as the top five risks that keep experts up at night. This year’s report is no exception, with extreme weather event-related risk ranking second in 2025.

Climate change was, as always, a key topic of discussion through the meeting’s main programme stream and hectic calendar of side events. A number of themes related to carbon markets shone through from the conversations.

The rhetoric is moving away from carbon offsets for the sake of carbon, instead focusing on nature and climate more holistically

Singapore’s President, Tharman Shanmugaratnam, highlighted at the event that nature-based climate mitigation solutions should be invested in as a priority, as their benefits extend beyond reducing and capturing carbon to reducing pollution, removing excess heat, improving disease management, and affecting multiple social benefits. ‘Think of nature-based solutions as a way of managing water, carbon emissions and preserving biodiversity,’ he said, ‘because if you think of them together, the ripple effect is much larger.’

The three emerging markets for nature – covering carbon emissions, biodiversity and water – are ‘intertwined and are really one challenge we face in the shifting ecology of the planet,’ he said.

The current finance gap for nature restoration projects is estimated to be around $700bn. It needs to be bridged not just to protect our planet but also the economy – around half of the world’s economic activity ultimately depends on the natural world.

This sentiment was echoed in a closed-door discussion at the Climate Impact Clubhouse in Davos. The change-makers working on nature-based solutions (NbS) presented different ways of valuing nature beyond carbon, discussing a range of solutions including insurance, bonds and other financial instruments to help drive capital into the sector.

Finance flows into the NbS market are estimated to be around $154bn a year, according to UNEP, less than half of the $384bn per year investment needed by 2025 and only a third of investment needed by 2030 ($484bn per year) to limit global warming to 1.5-2C and halt biodiversity loss.

It is paramount to close this gap, and while it is important to develop all instruments to help, the voluntary carbon market (VCM) still remains one of the most mature and effective tools currently in operation.

Luckily the VCM is already valuing carbon credits with strong biodiversity co-benefits. Abatable pricing data indicates that projects that comply with Climate, Community & Biodiversity (CCB) Standards already have a price premium, and demand is high for projects using methodologies that will be eligible for the Integrity Council for the Voluntary Carbon Market’s Core Carbon Principles (CCPs) or the upcoming ABACUS label for VM0047 methodology.

Our pricing data indicates that the highest-priced Afforestation, Reforestation, and Revegetation (ARR) projects (up to $90 per tonne) use Gold Standard methodologies that are considered more holistic and impact multiple SDGs beyond just carbon. The highest-priced Verra projects (at $46) have CCB labels, indicating they have positive impacts on communities and biodiversity.

A similar pricing dynamic can be observed in other NbS projects, which indicates that the VCM is able to value additional benefits beyond carbon. While this is a positive trend, we believe that these projects need to be valued higher still in order to help further bridge the nature finance gap.

Long-term net-zero goals need to be complimented with immediate action, where early-stage investment into carbon projects can help close the financing gap and secure high-quality carbon credit supply

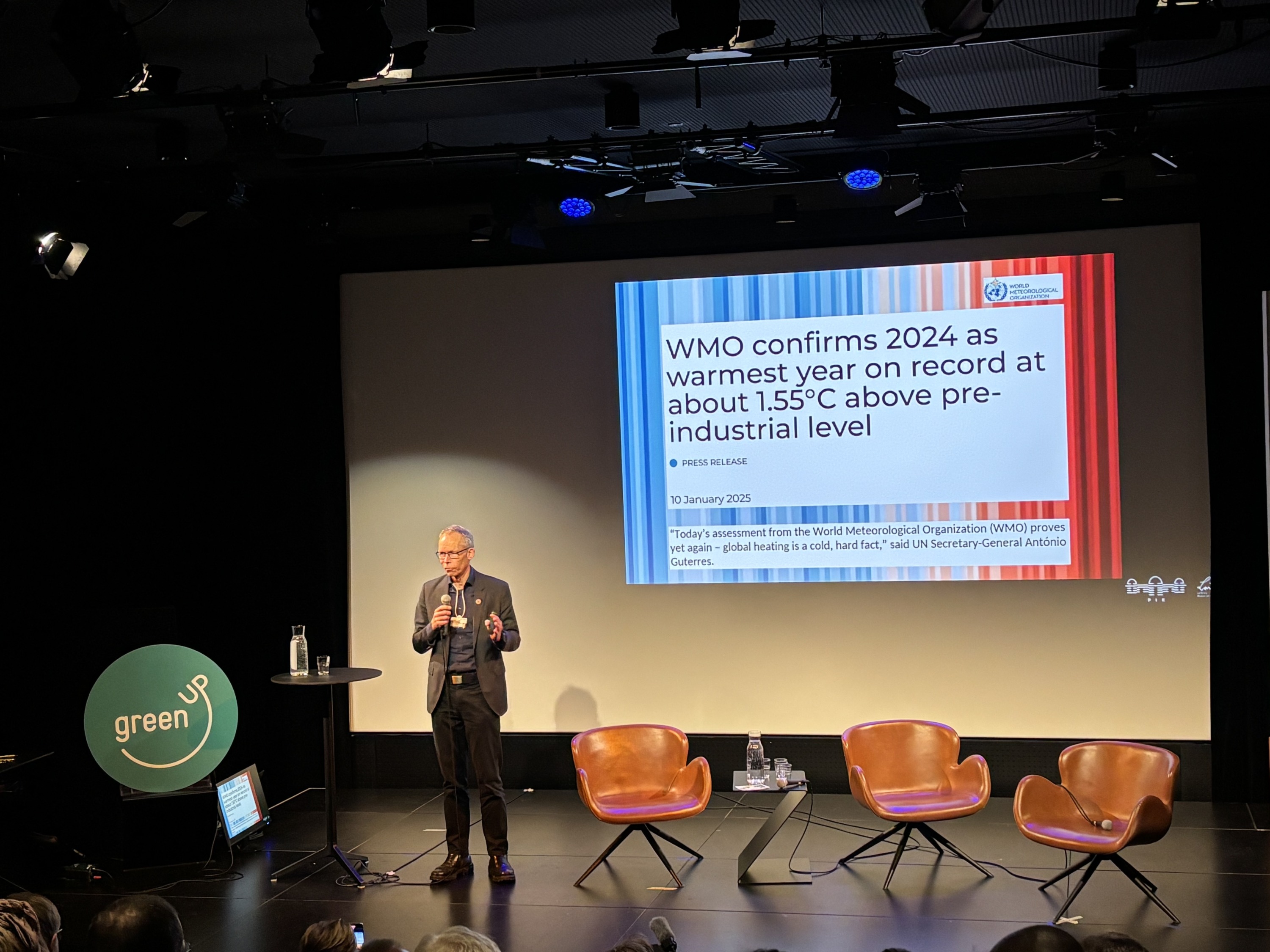

In his keynote speech at Davos’ Climate Hub, Professor Johan Rockström, the author of the Planetary boundaries concept, warned that humans have exited the ‘corridor of life’ – the comfortable climatic condition in which our civilisation has developed. Getting us back on track has never been more urgent.

Professor Johan Rockström at Davos

To provide an idea of how to achieve a systemic change, Kirsten Dunlop, CEO of Climate Kic, presented a new way of collaborating and growing horizontal connections across various climate action groups in order to support all actors in the system. The recently launched Systemic Climate Action Collaborative is determined to create such a paradigm shift, moving beyond siloed climate efforts to address the urgency and pervasiveness of the crisis. We couldn’t agree more with this way of horizontal collaboration where all actors must come to the table.

While still we are not investing nearly enough to reverse the devastating impacts of climate change, its good to note that forward investment in carbon projects is remaining steady. As Abatable’s new report, Decoding the Voluntary Carbon Market in 2024 and beyond, outlines, funding activity in the VCM reached $16.3bn in 2024, a level 18 times higher than the estimated value of carbon credit retirements in the same year.

This is positive news, but more investment is needed, and it is imperative to enable capital to flow into meaningful carbon projects earlier in their cycle to help close the funding gap and provide a secure high-quality supply for carbon credit buyers. Insurance can play a big role here to allow to de-risk such investments into the market.

We already have enough data, drive and technological innovations to make a difference

Action is happening on the business side of the equation. Davos’ SDG Tent had plenty of examples of positive climate initiatives.

Action Speaks hosted a session with business leaders who use their corporate commitments to achieve better environmental outcomes. For example, Jesper Brodin, CEO of IKEA holding company Ingka Group, shared that IKEA has managed to decrease its carbon footprint while growing the business at the same time. He convincingly argued that sustainability is not only the right thing to do but can also be very profitable and pragmatic.

IKEA plans by 2050 to reduce the absolute emissions from its value chain by at least 90% compared to 2016, following guidance from the Science Based Targets initiative, with residual emissions neutralised by removing and storing carbon within its own value chain.

Meanwhile, Melanie Nakagawa, CSO of Microsoft, one of the world’s largest purchasers of carbon removal credits, said that despite the turbulent political environment, the company takes a long-term view and is determined to stay on course to achieve its climate goals.

Microsoft is a market maker for high-quality carbon dioxide removal (CDR) projects and has purchased around 8.2mn tonnes. It is committed to supporting bioenergy and carbon capture and storage (BECCS), direct air capture (DAC), and biochar projects, among other project types.

For example, in July 2024, 1PointFive, which specialises in carbon capture, utilisation, and storage (CCUS) technology, announced a groundbreaking agreement with Microsoft to sell the firm 500,000 tonnes of CDR credits over six years. This deal, the largest DAC-enabled purchase to date, underscores the growing adoption of this technology as a viable solution for achieving net-zero emissions.

Meanwhile, Robert Metzke, Global Head of Sustainability at Philips addressed the need to speed up Scope 3 emissions accountability and abatement to drive transformation. In healthcare, it’s estimated that 71% of emissions come from the supply chain, and reducing them may have seven times more impact than simply lowering the company’s own direct emissions.

Philips uses an AI-powered tool developed with the Eindhoven University of Technology to identify the key factors that suppliers could focus on to enhance their performance in both social and environmental areas. In 2023, 93% of Phillips’ biggest suppliers participated in the exercise and reported a total of 14mn metric tonnes of CO2 savings from projects aimed at reducing emissions.

Our latest report finds that Scope 3 emissions are the largest driver of carbon credit purchases for large carbon credit retirees in the market.

Start-ups and scale-ups have an important role to play in driving innovation and providing solutions for climate, nature and people

Davos Climate Scale-Up day was teeming with optimism and social and technological innovations.

Kate Brandt, CSO of Google, for example, highlighted growing energy demand due to AI and outlined many new solutions to accelerate the global clean energy transition. More risk capital is required in this space to make sure that the speed of innovation can match the urgent need for it. While Google is investing in solutions to reduce emissions and drive efficiency within its own operation, like other tech giants it is also a market-maker for high-quality CDR.

The company has purchased a total of almost 800,000 tonnes of CDR to date through a combination of bilateral deals and participation in carbon credit buyers’ groups. The largest contributor to its portfolio is BECCS, followed by enhanced rock weathering, DAC, and NbS.

The convergence of AI and sustainability presents unprecedented opportunities to address climate change, and we at Abatable are optimistic about the power of technology to provide climate insights and support our incredible network of carbon project developers to implement holistic solutions on the ground.

Despite the ever-changing political landscape, Davos highlighted so much action happening from all corners of industry, business, NGOs and governments. While many innovative solutions can empower internal decarbonisation within companies, residual hard-to-abate emissions still need to be offset with high-quality CDR, which we can all empower and support.

To find out more about how Abatable can support your carbon credit sourcing goals, visit our website. Download our latest report on the voluntary carbon market, Decoding the VCM in 2024 and beyond, here.