2024 was yet another eventful year for the voluntary carbon market (VCM) and its place in a rapidly changing climate mitigation landscape.

Unpacking the current state of the VCM beyond credit issuances and retirements reveals a market being reshaped around critical advancements in supply-side and carbon claim integrity, a sustained level of primary funding for high-quality carbon projects, evolving frameworks for corporate climate strategies and the formation of new international markets for carbon credits.

Our new report decodes all of these dynamics in detail. Sign up to our free platform to download it.

Already have an account? Download the report here.

About the report

Decoding the voluntary carbon market in 2024 and beyond is the 2025 edition of Abatable’s annual Carbon Market Developer Overview report series, with an expanded focus this year and additional insights on carbon credit demand, prices and policies alongside analysis of the carbon project developer ecosystem.

The report’s release coincides with our new database tracking all funding announcements in the VCM, also available in our platform. We have also refreshed our VCM supply and demand insights module, giving corporate buyers in the market access to our full developer database to find supply aligned to high-integrity initiatives.

Decoding the VCM in 2024 – key findings

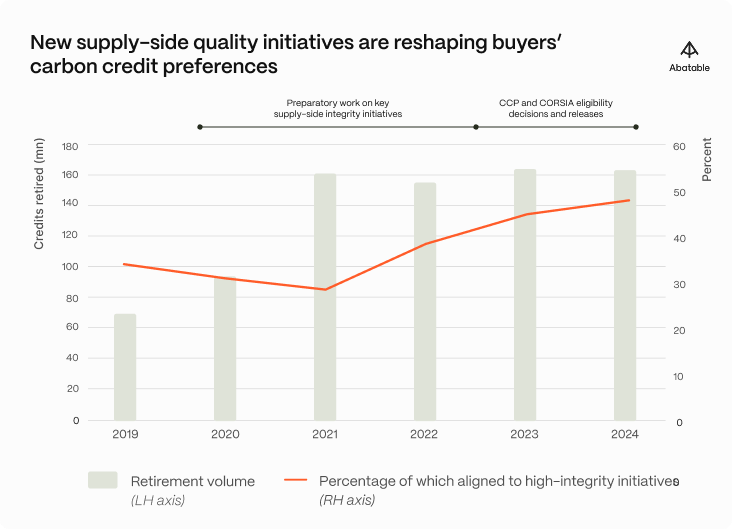

Decoding the voluntary carbon market in 2024 and beyond finds that the impact of high-integrity carbon credit initiatives is beginning to be reflected across the market. The volume of credits retired aligning to the Integrity Council for the Voluntary Carbon Market (IC-VCM) Core Carbon Principle (CCP) or CORSIA quality standards increased from 29% in 2021 to close to 50% in 2024.

Buyers are also beginning to pay more for these credits. Abatable’s carbon credit pricing data indicates that CCP-labelled credits are commanding an up to $10 price premium in the market.

On the market’s supply side, the report shows that credits issued from carbon project developers are also increasingly aligned with high-integrity initiatives. 56% of the largest 25 developers’ issuances from the last three years are now aligned with these initiatives, compared to 46% in 2022. The increase is more apparent for smaller project developers, with 65% of issuances from the last three years now aligned with high-integrity initiatives compared with 45% in 2022, indicating that buyers looking for quality may need to dig deeper into the market.

Remarkably, the scale of carbon market funding deals in 2024 – $16.3bn – was 18 times larger than the activity observed in the credit retirement market, highlighting the strategic significance of long-term engagements in high-integrity carbon credit projects. This underscores the enduring commitment of corporate buyers and large investors to the VCM.

About Abatable

Abatable is on a mission to enable all organisations to build a thriving future for climate, nature and people. We develop next-generation tools to allow organisations to efficiently source and utilise high-quality carbon credits as part of their sustainability strategies. Our carbon market solutions are built on a foundation of cutting-edge technology and deep carbon project developer relationships, enhanced by our extensive expertise. We are a trusted partner for organisations looking to go beyond transactional relationships to create long-term impact through carbon markets.

Contact us to find out how we can help you navigate the carbon market and source high-quality carbon credits.