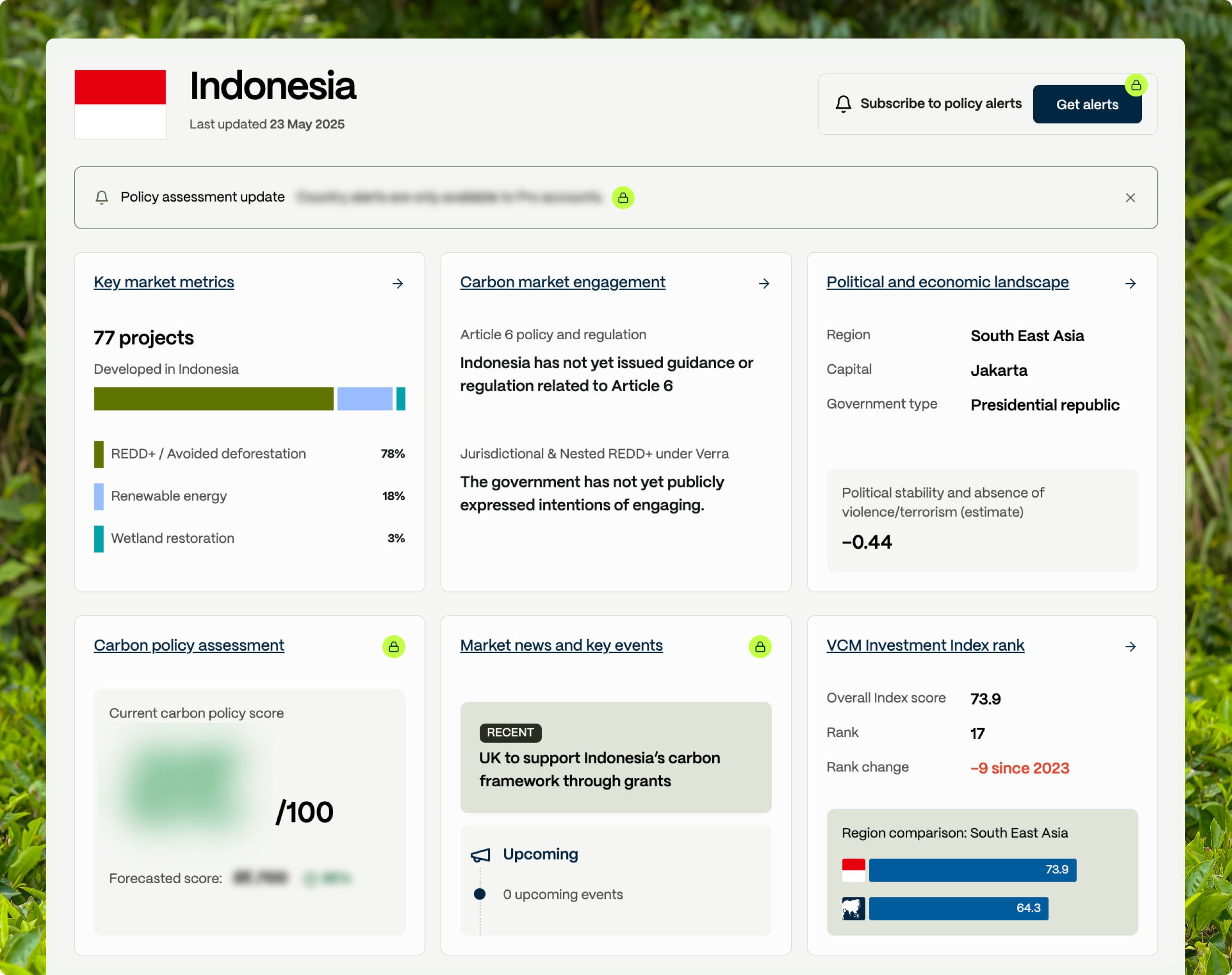

Indonesia’s carbon market is starting to reopen for business. The regulatory landscape remains complex, however, and there are some critical areas carbon credit buyers and investors should keep an eye on. Abatable’s Indonesia policy profile can help you stay up to speed with developments.

Earlier this month the UK’s Partnering for Accelerated Climate Transactions (PACT) announced that it is providing £1.1mn to strengthen carbon market infrastructure and regulatory frameworks in Indonesia.

The announcement is part of a series of relevant developments for carbon markets in the country and follows the news earlier in May that the country has signed a Mutual Recognition Agreement with the independent carbon certification body Gold Standard.

The landmark agreement formally recognises emission reduction units issued by Gold Standard in Indonesia, and should pave the way for Gold Standard-certified projects to be listed on the country’s national carbon registry (SRN PP). This is a crucial prerequisite for these projects to obtain export approval for their carbon credits. Other independent registries including Verra and Global Carbon Council are said to be close to finalising similar agreements.

Back in business?

These updates follow Indonesia resuming the international sale of carbon credits in January – ending a three-year moratorium on exports. A set of energy-related projects developed using Indonesia’s national SRN methodologies became the first in the country to receive Letters of Authorisation, allowing credits generated by them to be sold internationally.

The credits were listed on Indonesia’s carbon exchange IDXCarbon, through which all trading of credits must now take place. However, so far, reported trades have been limited, with the national standard not receiving Core Carbon Principle approval or eligibility under the CORSIA aviation offsetting scheme as yet – key drivers for market demand.

Crucially, forestry projects are not yet eligible to issue and trade credits. REDD+ projects make up 78% of Indonesia’s historical carbon credit supply from independent standards meaning, even as Indonesia reopens, the market remains stunted.

While these developments demonstrate Indonesia’s commitment to supporting its voluntary carbon market (VCM), the regulatory landscape remains complex and unorthodox.

Businesses looking to engage with carbon projects in Indonesia must carefully understand the country’s evolving policy, including opportunities and potential risks.

Abatable’s Indonesia policy profile includes news and policy risk alerts on the above developments and more. It is just one of the detailed policy profiles within our free-to-access intelligence platform, designed to help companies, investors, and project developers navigate the complexities of carbon markets with confidence – from their legal frameworks and approach to carbon rights to their engagement with Article 6 of the Paris Agreement.

Sign up for free to access our policy profiles.

A unique and evolving carbon policy landscape

Indonesia has a pivotal role to play in the global carbon market. Home to the world’s third-largest tropical forest, it offers immense potential for high-quality nature-based carbon projects. But it has also taken a more measured and controlled approach to developing its carbon market than many of its regional peers.

Abatable’s Indonesia carbon market policy profile

In 2022, the government introduced a ban on the export of carbon credits generated within its borders. This move was intended to develop the domestic market and ensure that the economic benefits of carbon projects remained within the country.

With the recent lifting of this ban, Indonesia is opening its doors to international participation once again. Despite this, the government continues to maintain strict oversight over project approvals and revenue-sharing arrangements from domestic carbon projects.

This approach reflects Indonesia’s broader ambition: to position itself as both a responsible steward of critical ecosystems and a competitive player in global climate finance. For businesses, this means that understanding the country’s regulatory environment is just as important as recognising its market potential.

What businesses should watch

Indonesia’s carbon policy rests on several key pillars that companies and investors should keep a close eye on:

- A dual-track market system: Indonesia is building both a compliance market under its cap-and-trade system (SPE-GRK) and a voluntary carbon market. Notably, the voluntary market now includes clear provisions for international cooperation, signalling greater openness to cross-border carbon credit transactions.

- Domestic benefit-sharing requirements: Developers are expected to ensure local communities receive tangible benefits from the sale of carbon credits, particularly for nature-based solutions such as reforestation and peatland restoration. This is essential not only for maintaining government legitimacy but also for the credibility and social licence of projects.

- Article 6 readiness: Indonesia is actively involved in negotiating bilateral agreements under Article 6 of the Paris Agreement and has established a national registry to align carbon crediting with international standards. However, its approach to Corresponding Adjustments (the accounting mechanism to avoid double counting) remains in development. Buyers seeking credits for offsetting purposes should monitor these evolving rules closely.

- Strategic sectors: While forestry remains the dominant source of carbon credits from Indonesia, the government is increasingly focusing on the energy transition and industrial decarbonisation as emerging areas for credit generation and climate action.

Confidence in compliance, clarity for corporations

The recent MRA with Gold Standard and the lifting of the export ban demonstrate Indonesia’s commitment to unlocking international investment while retaining regulatory control. For corporate buyers and project developers, this creates exciting new opportunities. But it also emphasises the importance of transparency and alignment with local policies.

Abatable’s Indonesia policy profile distils these complexities into clear, actionable insights. Our platform covers:

- The national market structure and project registration requirements

- Treatment of carbon rights and benefit-sharing rules

- Interaction with Article 6 mechanisms and Corresponding Adjustment policies

- Government attitudes towards the VCM and corporate offsetting

- Policy stability, regulatory timelines, and anticipated developments

Stay informed, act with confidence

As more companies turn to Southeast Asia in search of high-quality carbon credits and nature-based solutions, Indonesia’s evolving policy landscape will play a defining role in shaping climate investment across the region.

To gain a deeper understanding of this critical carbon market to make informed decisions, sign up for free access to Abatable’s intelligence platform, where you can also explore carbon market information for 115 other countries.