In the first of three CORSIA articles from Abatable, Juan Carlos Arredondo Brun outlines the latest CORSIA developments as the aviation industry anticipates publication of the first compensation requirements under the scheme.

CORSIA, the Carbon Offsetting and Reduction Scheme for International Aviation, is rapidly becoming one of the most closely watched mechanisms in carbon markets – and for good reason.

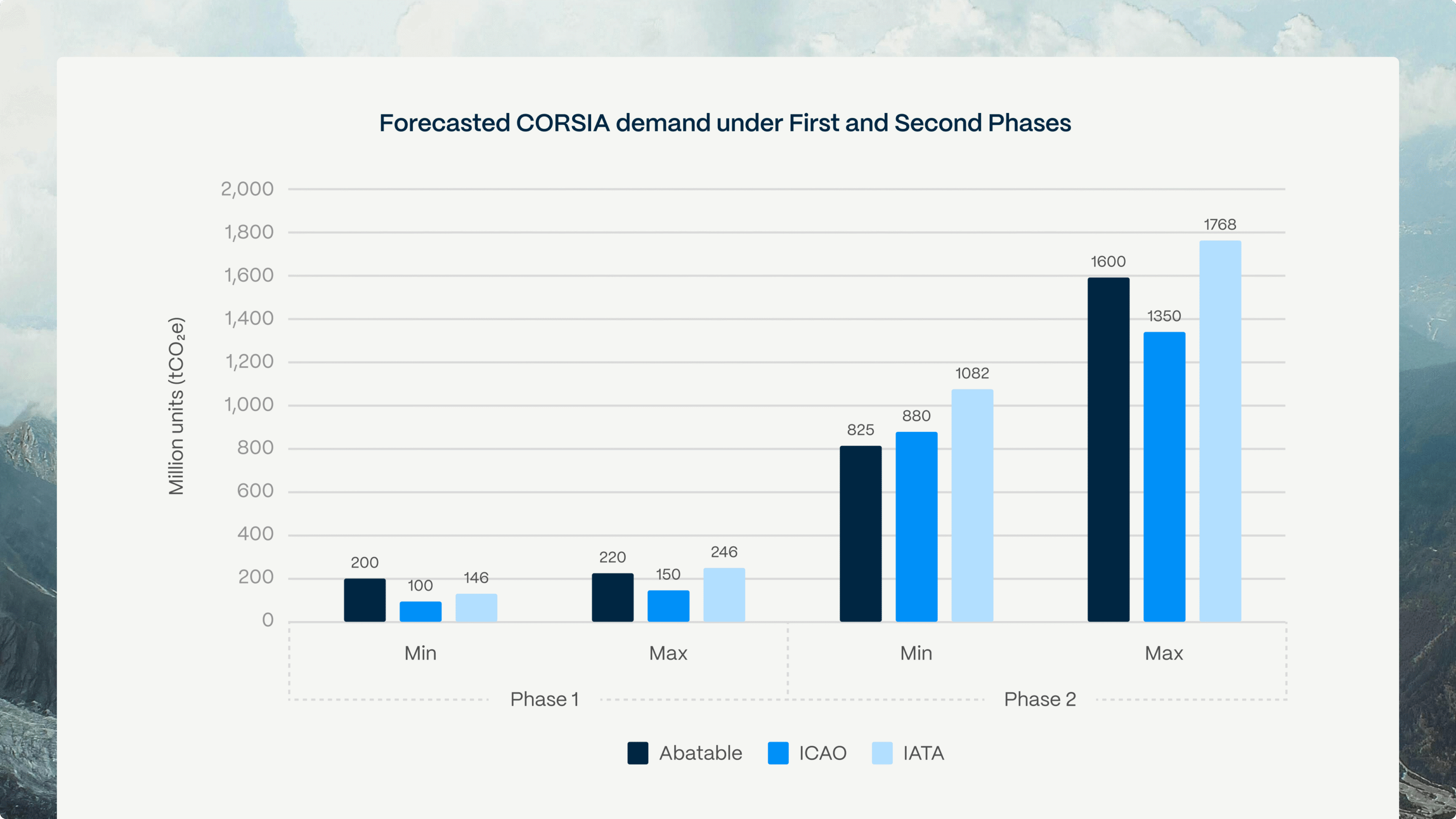

Recent estimates for airline eligible credit demand under the scheme from Abatable, the International Air Transport Association (IATA), and the International Civil Aviation Organisation (ICAO), indicate that the 670 airlines participating in CORSIA’s First Phase (2024–2026) could generate demand for between 100 and 246mn tonnes of CO2 in carbon credits, with Abatable’s forecast ranging between 135 and 220mn tonnes (see Figure 1).

Figure 1. Forecasted minimum and maximum CORSIA carbon credit demand scenarios under the scheme’s First and Second Phase from Abatable, ICAO and IATA. Updated November 2025.

CORSIA is regulated by ICAO – a UN agency coordinating international cooperation on aviation – as a global market-based mechanism designed to address and compensate for emissions growth from international civil aviation. Under CORSIA, airlines are obligated to use carbon credits to cover increases in their emissions above a 2019 baseline. Read more on the scheme here.

To help both credit buyers and project developers understand the scheme’s status and direction, this blog post unpacks the key CORSIA-related outcomes from ICAO’s recently hosted 42nd Assembly and their implications for the market.

Assembly outcomes

1. CORSIA implementation is on track, but procurement has yet to begin

CORSIA remains on schedule, with 130 countries now voluntarily participating in the scheme’s First Phase (2024–2026). ICAO outlined that core processes are well established and are progressing as planned. For example:

- Airlines are preparing and submitting their annual emissions and sustainable aviation fuel (SAF) use reports.

- Civil aviation authorities in host countries are validating this data and forwarding it to ICAO for all designated airlines.

- ICAO is compiling, assessing, and publishing annual emissions figures per country, route, and airline to inform CORSIA compensation obligations.

- ICAO’s Council is monitoring the supply, demand, and pricing of CORSIA-eligible units.

However, CORSIA will only start to have a material impact on emissions once airlines begin purchasing eligible units. The first significant demand signal is expected towards the end of October this year, when ICAO will release verified emissions data for 2024 and thus the corresponding compensation credit volumes airlines will need to purchase to comply with the scheme.

2. CORSIA could be extended beyond 2035

From the outset, CORSIA was conceived as a market-based scheme to supplement (but not replace) the adoption of decarbonisation measures in the aviation industry, such as ground and aerial operations efficiency, aircraft technology, and the use of eligible SAFs.

During the 42nd Assembly, countries reaffirmed their ongoing support for the scheme and, importantly, no opposition emerged. Discussions amongst ICAO members also opened the possibility of extending CORSIA beyond 2035.

Any formal extension will depend on the outcome of a special review in 2032, but the very fact that the conversation is underway signals growing confidence in the scheme’s role within aviation’s long-term decarbonisation pathway.

3. ICAO has urged its members to issue Letters of Authorisation (LoAs)

Many ICAO Member States and aviation industry representatives emphasised the urgent need for ICAO countries to support CORSIA implementation by issuing Letters of Authorisation (LoAs). LoAs are issued by governments to indicate that they will apply a ‘Corresponding Adjustment‘ to emissions reduction or removal units and thus not count them under their country-level decarbonisation efforts. This is a means to avoid double-counting of emissions under the Paris Agreement’s Article 6 emissions trading framework.

LoAs are critical in ensuring that emissions reductions sold to airlines are properly accounted for and not double-counted towards host countries’ own Paris Agreement Nationally Determined Contributions (NDCs).

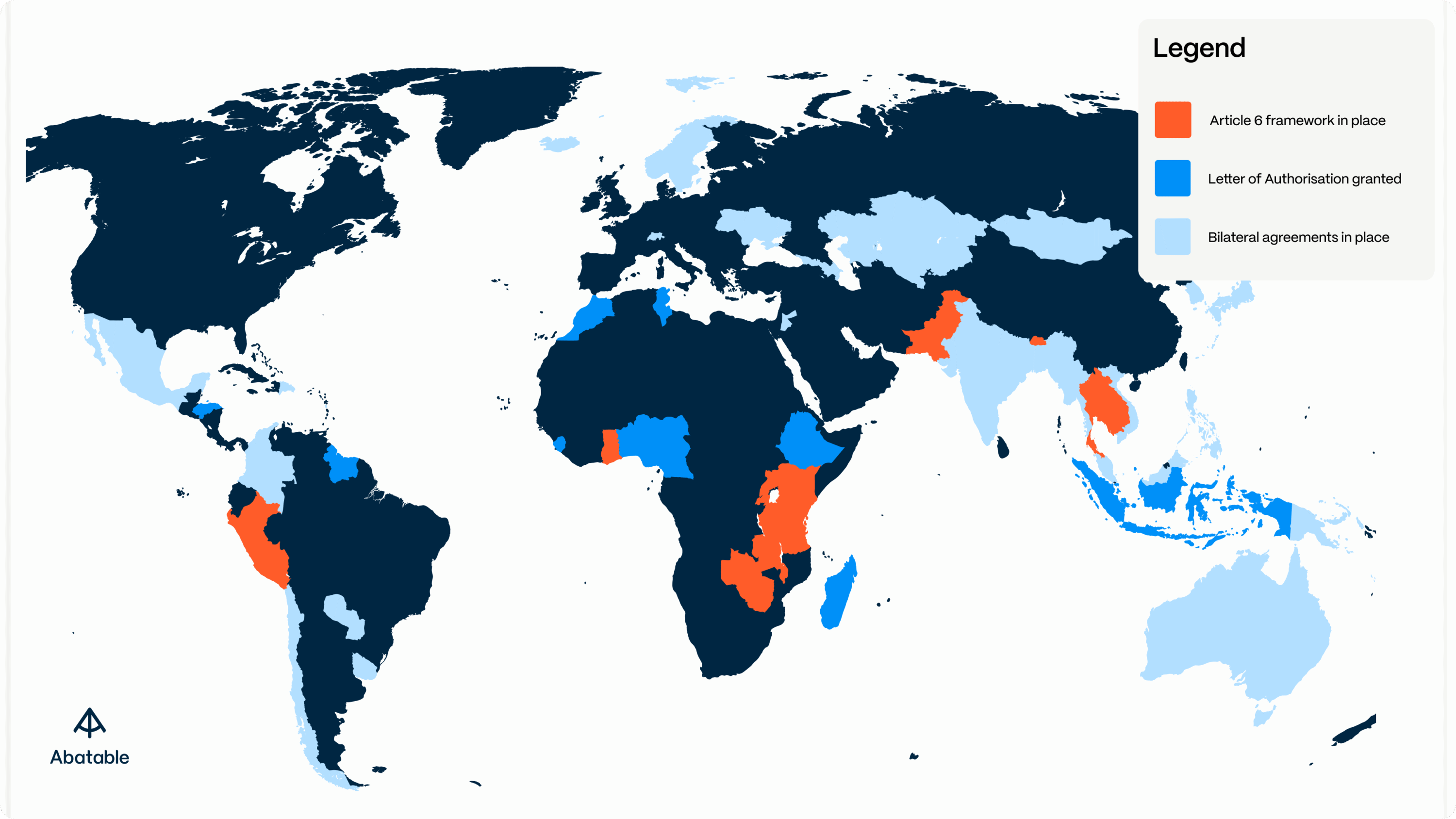

However more LoAs are needed to boost the eligible supply under CORSIA. At the end of 2024 just 40 projects supplying 16mn tonnes had LoAs associated with them, according to Abatable analysis. This is compared to the 325mn tonnes available in the VCM and the over 100mn tonnes needed in the First Phase of CORSIA. Countries that have issued a Letter of Authorisation or which have an Article 6 framework in place can be seen in Figure 2.

Figure 2. Countries that have a full Paris Agreement Article 6 framework in place (orange), countries that have issued Letters of Authorisation (dark blue), and countries with bilateral agreements in place to trade emissions under Article 6 (light blue). Countries with Article 6 frameworks may have also granted LoAs – contact Abatable for more information. Source: Abatable, October 2025

A complete list of the 98 supportive countries for LoA issuance is available here.

What should airlines know when procuring CORSIA-eligible units?

For airlines preparing to participate in CORSIA’s First Phase, understanding the scheme is crucial to navigating it effectively. Only units that meet the below criteria can be used for offsetting under CORSIA:

- Units must be labelled as CORSIA-eligible for the First Phase

- Only CORSIA-approved standards can tag or label credits as CORSIA-eligible.

These requirements aim to maintain consistency and environmental integrity, ensuring that only verified, high-quality credits are used for compliance purposes.

Get in touch with us to explore how to procure CORSIA-eligible units.

How is CORSIA-eligible supply created?

For project developers and investors looking to position themselves within the CORSIA market, the eligibility landscape can be complex. Understanding the technical parameters below is key to ensuring that generated credits can be sold into the scheme:

- Only CORSIA-eligible credit registries apply.

- Many existing methodologies are not applicable and should therefore be excluded from project planning.

- The project’s first crediting period must have started no later than 1 January 2016.

- Credits or units must have a vintage of 2021 or later.

- Some methodologies used by CORSIA-eligible standards may also have received Core Carbon Principles (CCP) approval from the ICVCM, which can enhance their market profile. However, the CCP label does not replace the CORSIA eligibility requirement.

For developers and investors, understanding these parameters early is critical to ensuring market access and maximising the commercial viability of projects designed to supply CORSIA demand.

Get in touch with us to explore further.

Final thoughts

CORSIA is fast evolving from a policy framework to a functioning international market. With emissions data for the scheme’s first year soon to be published and the first compliance cycle approaching, airlines, project developers, and investors alike need to prepare for a competitive carbon procurement environment.

For airlines, that means identifying credible suppliers and securing access to eligible units early. For developers and investors, it means ensuring project alignment with CORSIA requirements to capture the growing demand.

As implementation accelerates, CORSIA is set to become one of the largest international carbon markets. Its influence will shape aviation’s pathway to net zero and influence how other compliance carbon markets evolve worldwide.

Read more from our CORSIA series:

CORSIA dispatches from IATA’s World Sustainability Symposium

CORSIA compliance: Airlines need to offset 58 MtCO2 to cover 2024 emissions

For more insights on CORSIA market dynamics and procurement strategies, sign up to Abatable’s market intelligence platform. Contact our team to learn how our airline-specific forecasting can enhance your compliance planning and procurement outcomes.