The UN’s Paris Agreement Crediting Mechanism (PACM) represents a pivotal evolution in international carbon markets. In this first instalment of our three-part series, we break down where things stand for Article 6.4, exploring the state of play for project developers, investors, and carbon market participants.

Following the finalisation of the Paris Agreement Article 6 rulebook at COP29 in Baku, and significant updates for both Article 6.2 and 6.4 at COP30 in Belém, the momentum behind international carbon cooperation continues to build. Over 60 countries now reference Article 6 mechanisms in their updated Nationally Determined Contributions (NDCs), including major economies like Japan, South Korea, and Switzerland, as well as developing nations across Africa, Asia, and Latin America.

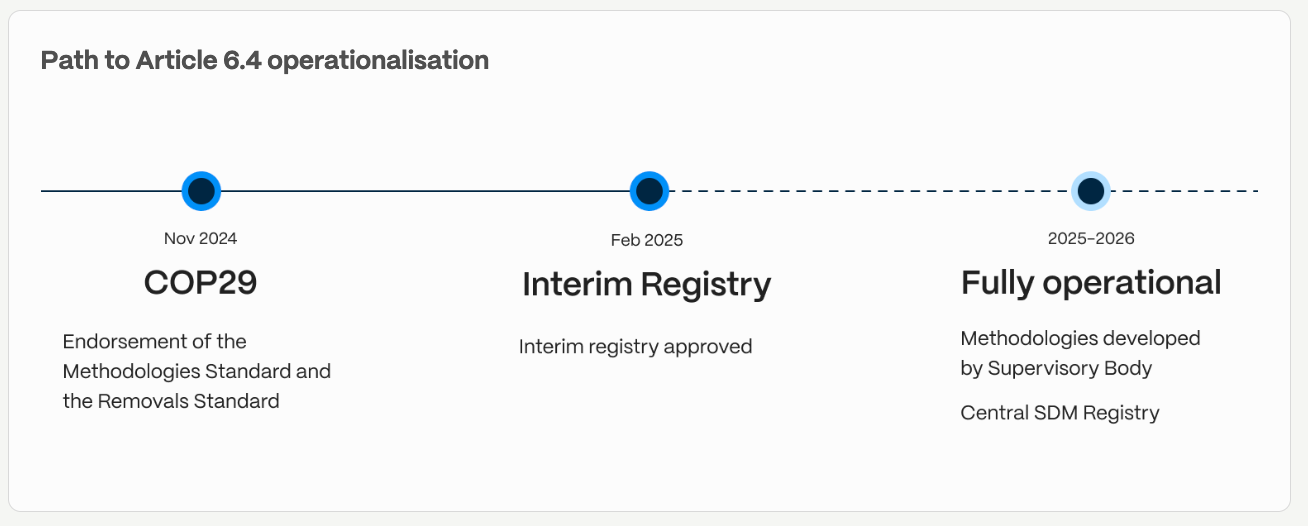

2026 is set to be another vital year for Article 6.4, which established PACM, the UN’s mechanism for country-to-country carbon trading via a centralised registry. The first units under the mechanism are expected to be issued early this year, with all projects expected to use new PACM methodologies. These are expected to be published throughout the year.

With emissions and temperatures continuing to rise, and countries increasingly banking on carbon markets to achieve their climate goals, understanding the current state of Article 6.4 and PACM has never been more important.

PACM is the successor to the Clean Development Mechanism (CDM) and introduces a new framework for high-integrity carbon crediting that aligns with countries’ climate commitments under the Paris Agreement. This mechanism, if designed correctly, stands to unlock significant capital flows for climate action while ensuring environmental integrity through robust international oversight.

The potential wins are substantial: Article 6.4 could reduce the cost of implementing NDCs by more than half by 2030, potentially enabling countries to increase their climate ambition. For market participants, it offers new opportunities in a rapidly changing carbon landscape.

Developments from Article 6.4’s Supervisory Body

The Article 6.4 Supervisory Body (SBM) delivered significant progress in operationalising the mechanism in 2025, with a comprehensive package of standards covering the entire project lifecycle, from validation and verification requirements to CDM transition pathways and accreditation procedures.

It oversaw the adoption of five methodological standards (baseline-setting, additionality, leakage, suppressed demand, and non-permanence/reversals), approval of the first PACM methodology – for landfill gas flaring/use – and accredited 10 designated operational entities (independent third-party organisations to verify carbon projects).

Permanence standard unlocks nature-based solutions

The most consequential advancement has been the approved standard on non-permanence and reversals, addressing one of carbon accounting’s most debated challenges: managing the risk that carbon stored through reforestation, soil, or land-use projects could be released back into the atmosphere.

The permanence standard establishes four key principles:

- Flexible monitoring periods: Perpetual monitoring has been dropped. Each methodology will specify its own monitoring duration, with responsibilities transferable to host countries or third parties, while reversal liability remains with project participants unless alternative safeguards exist.

- Methodology-level risk assessment: Rather than fixing ‘negligible risk’ at a specific threshold, each methodology must define its own acceptable risk level using the Paris Agreement Crediting Mechanism’s Reversal Risk Assessment Tool.

- Multiple exit pathways: Projects can address reversal obligations through unit cancellation, insurance, or third-party guarantees, with forthcoming guidance emphasising flexibility for innovative approaches like buffer pools.

- National sovereignty preserved: Host countries retain final authority on Corresponding Adjustments and their application to buffer pools, with the SBM actively seeking practical input on accounting implications.

By delegating permanence parameters to individual methodologies rather than setting universal standards, the SBM has chosen flexibility over standardisation. This approach accommodates national circumstances and enables innovation, but introduces a potential challenge: permanence requirements may vary significantly across project types and geographies, creating less comparability.

Infrastructure taking shape

With the interim registry launched, designated operational entities in place, and core integrity standards now approved (additionality, methodologies, removals, and permanence), the technical scaffold is complete. However, approval of specific project methodologies remains the critical bottleneck preventing full operationalisation of PACM. These methodology approvals will determine whether Article 6.4 delivers on its promise to set a new quality benchmark for carbon markets.

Operational status and timeline

It’s important to understand that while progress is substantial, Article 6.4 is still not fully operational. Despite CDM activities having a transition pathway and process, no credits can be issued until two key elements are established:

- A registry (and guidance from the secretariat on it).

- A wider range of approved methodologies by the SBM.

The SBM is prioritising methodology reviews in key sectors like renewable energy and energy efficiency, responding to the CDM transition pipeline where most projects fall into these categories.

Despite the lack of complete frameworks, some host countries have already started to approve the transition from CDM activities to the new mechanism, demonstrating growing confidence in this new market approach.

While the CDM transition pathway offers an important bridge to scale Article 6.4 quickly, it’s worth noting significant concerns about the integrity of transitioning units, particularly given the composition of the pipeline. Renewable energy projects, which historically dominated the CDM and comprise a substantial portion of projects seeking transition, have faced mounting criticism over additionality.

2026 is a pivotal year for PACM, with critical upcoming milestones that will be integral to how 2025’s debates around ambition and integrity play out in the mechanism itself.

Read more from our Article 6.4 series:

02 – Getting ready for Article 6.4: Practical steps for carbon projects

03 – Bridging markets: How Article 6.4 creates new carbon finance opportunities

You can also explore our Article 6.4 theme in the Abatable Platform.

To understand more about how to approach Article 6.4 from a supply or demand perspective, get in touch to speak with one of our experts.