Contents

Welcome to the Abatable market intelligence data FAQs. This page aims to answer questions about Abatable’s data sources and how we process them to ensure accuracy and reliability.

- What are your data sources?

- How do you ensure the data is accurate?

- What differentiates Abatable from other VCM data providers?

- How frequently do you update the data?

- Can I export your pricing data?

- Can I quote your prices for my reporting?

- What else should I know about prices?

Transparency is at the heart of our approach, and we believe it’s crucial for building trust and confidence in the insights we provide. We are committed to providing accurate, reliable data and are always open to feedback and questions. For more information or any queries, please contact us at [email protected]

What are your data sources?

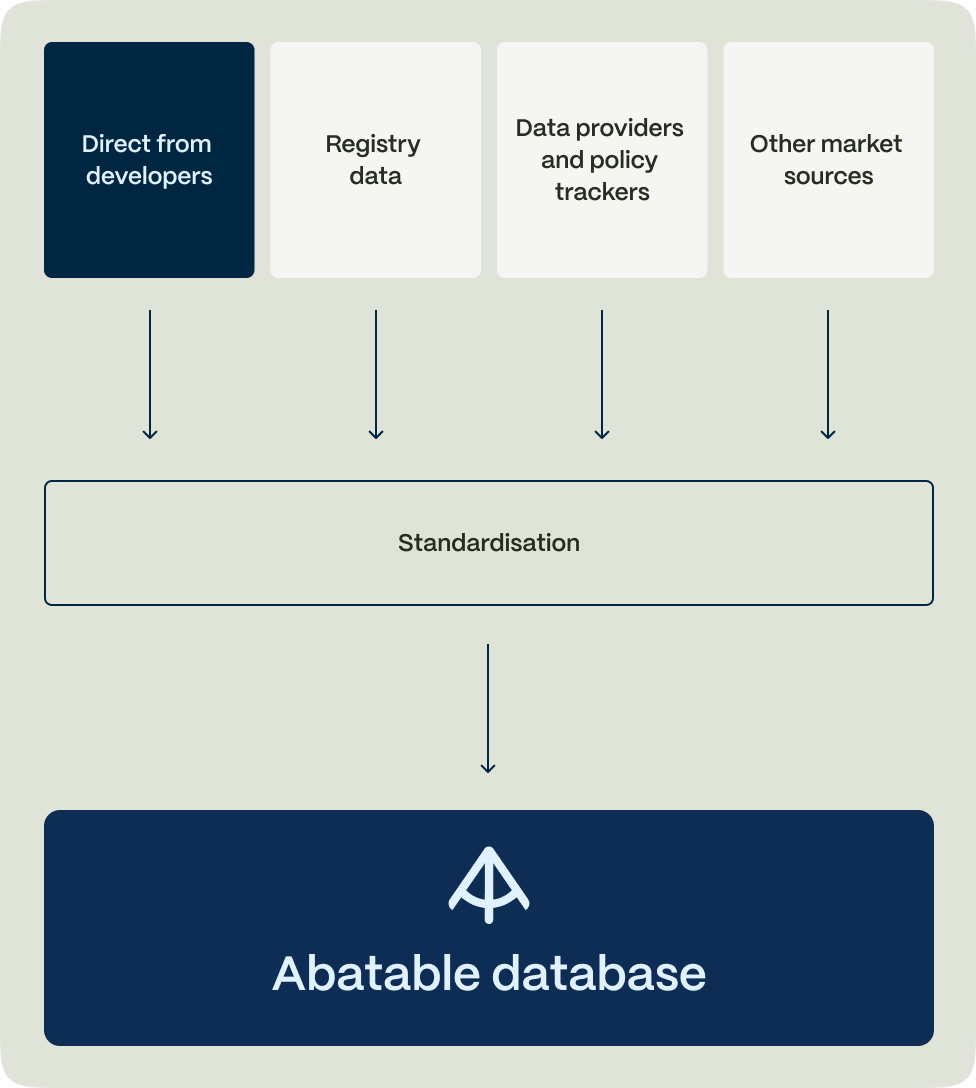

Our data comes from a mix of public registries, partnerships, developer contribution and other market sources.

Registries

Project information is sourced from various carbon registries, including but not limited to project location, crediting periods, issuance and retirement records. We also create a unique profile for each developer identified across registries, incorporating developer location and contact information from publicly available Project Design Documents (PDDs). Leveraging registry data enriches our understanding of market movements and ensures we provide our subscribers with the most timely developer ecosystem updates.

A full list of registries we source: Verified Carbon Standard, Gold Standard, Puro Earth, Plan Vivo, American Carbon Registry, Climate Action Research, EcoRegistry, COLCX, Global Carbon Council, ART Trees, UK Woodland Carbon Code, CSA and BioCarbon.

Developer-contributed data

In addition to public registries, we collect data directly from developers via Abatable’s carbon sourcing platform. On this platform, developers invited to respond to RFPs (Request for proposals) share with us detailed information about their project pipeline, projected volumes, carbon schedule and VCM experience that are typically unavailable to the general public. We also receive pricing offers in developers’ responses, including spot, forward, and pre-payment offers, which are then aggregated and anonymised to enhance our pricing intelligence module.

This exclusive data source provides first-hand and most current information, allowing us to stay ahead of industry trends. Read more about why our data is differentiated here.

Partnerships

We actively engage with marketplaces (such as The Gold Standard Marketplace) and intermediaries in the VCM. These partnerships broaden our data coverage and enrich our insights by incorporating diverse perspectives and transaction datasets. Our objective is to ensure that our data accurately represents the market by sourcing information from various market players, thus reflecting the complexities of prices in the VCM.

Subscribers have the option to filter by price source in our pricing intelligence module. This feature allows the access to price trends most pertinent to your investment decisions or benchmarking requirements.

Furthermore, our acquisition of Ecosphere+, a leading provider of nature-based carbon credits, allows us to expand our pricing coverage significantly. Since its founding in 2016, Ecosphere+ has transacted over 45 million carbon credits with extensive experience in the VCM. By incorporating their historical transaction records, we can now offer unparalleled insights into nature-based pricing trends.

Other sources

Our Knowledge & Data team is dedicated to identifying new external data sources to enhance our product coverage.

For carbon funding deals, we independently gather Verified Emission Reduction Purchase Agreements (VERPAs), corporate procurements, and public and equity carbon project funding from diverse news outlets. This comprehensive data collection enables us to analyse the funding landscape, providing insights into future supply potential.

Our country policy profiles are compiled from a variety of reputable sources to ensure comprehensive and accurate assessments. The global carbon market readiness score relies on countries’ Nationally Determined Contributions, national carbon regulations, media announcements, the REDD+ platform, and the ART Trees website. The political and economic landscape section uses publicly available data from sources such as the World Bank, Transparency International, and the CIA World Factbook. For understanding our carbon policy assessment, please refer to our detailed methodology. Market news and key events are monitored through news outlets and press releases, ensuring we stay current with the latest developments. By integrating these diverse sources, we ensure our country policy profiles are robust, current, and reflective of the latest developments in the carbon market landscape.

How do you ensure the data is accurate?

We use robust cleaning, standardisation, and quality assurance processes to maintain high data quality.

Our data undergoes regular audits and updates. This quality assurance process includes cross-checking data sources and implementing automated and manual checks to uphold data integrity. We perform weekly data management tasks to validate data sourced from registries and developer submissions and resolve discrepancies.

We also conduct rigorous cleaning and standardisation for data integration. This involves data transformation, outlier identification, and addressing challenges such as capitalisation inconsistencies to prevent duplication and misclassification. For example, by systematically identifying and standardising developer names written in different formats, we ensure the accuracy of our developer database and the reliability of our developer league table in Credit supply insights.

What differentiates Abatable from other VCM data providers?

Abatable distinguishes itself by collecting exclusive project data and pricing offers directly from developers through our carbon sourcing platform.

We facilitate carbon sourcing for clients by conducting Requests for Proposals (RFPs). On our digital platform, we invite developers with projects that meet specific buyer requirements to submit their offers. Developers provide detailed information about their portfolios, which is typically not available to the general public. This information includes their experience in the carbon market, project history, carbon schedules, and interactions with local communities to achieve project Sustainable Development Goals (SDGs).

For each project, we receive vintage-level pricing offers and expected delivery dates. These offers include spot, forward, and pre-payment options, along with associated volume-based discounts. The pricing offers are then aggregated and anonymised to enhance our pricing intelligence module.

This exclusive data source allows us to access first-hand, up-to-date information and provide unique pricing insights to our clients.

How frequently do you update the data?

We update our data at different intervals depending on the source. Registry data is synced weekly, while partner data is updated on a monthly basis. Updates to developer-contributed data are not on a fixed schedule and occur as frequently as new Requests for Proposals (RFPs) are initiated. Additionally, we receive project-level pricing information intermittently throughout the year, driven by developers’ pipeline and demand indicators.

Can I export your pricing data?

We do not currently support an export function. However, if there is a specific type of analysis or graph you would like to see but we do not provide, we would be happy to hear your suggestions.

Can I quote your prices for my reporting?

Yes, you may include our pricing trends or individual price points in your reports. Please ensure you credit Abatable as your source, either through screenshots or direct citation.

What else should I know about prices?

We receive offers across different stages of project’s life cycle — pre-issuance, validation, and verified credits. As a result, the pricing offer data may sometimes represent pre-payment discounted prices relative to market prices. These differences can be identified by the data source column and the vintage years, which are typically set in the future.

Additionally, forward prices are not forecasted prices. Forward prices are offers for future vintages provided directly by developers who are either seeking pre-issuance funding for their projects or looking to secure buyers in advance. It’s important to note that these prices are not generated through statistical predictive models but are set by the developers themselves.