Abatable’s Juan Carlos Arredondo Brun and Bryan McCann were on the ground at IATA’s World Sustainability Symposium 2025 in Hong Kong. In the second article in our CORSIA series, Bryan McCann breaks down the key takeaways from the event.

IATA’s World Sustainability Symposium (WSS) 2025, taking place this year in Hong Kong, brought together over 500 participants from around the world to discuss prominent topics in aviation decarbonisation, including net-zero strategies, sustainability initiatives, and green financing, as well as CORSIA implementation, sustainable aviation fuels, and new aircraft technologies.

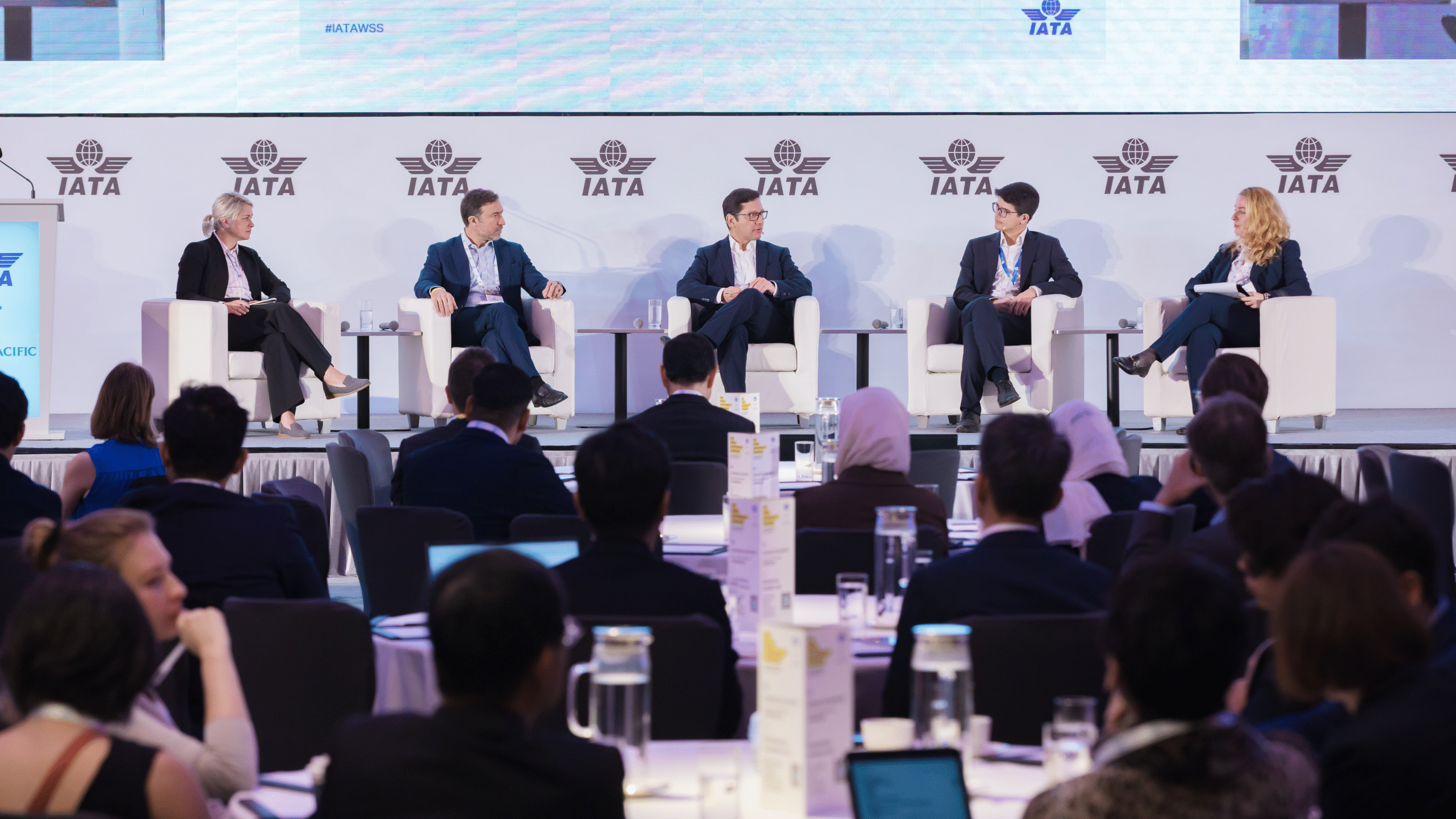

The busy conference stream featured a session on CORSIA, the Carbon Offsetting and Reduction Scheme for International Aviation, where participants including Abatable’s Juan Carlos Arredondo Brun discussed the importance of government capacity building for countries hosting carbon projects, as well as education on the revenue opportunities available from doing so.

Abatable’s Juan Carlos Arredondo Brun (centre) at IATA WSS’s ‘Accelerating the implementation of CORSIA’ panel alongside (left to right) Molly Peters-Stanley, Senca Vantage LLC, Boris Hristov, KOKO, Rocco Huesch, Valor Carbon, and Judit Legrady, South Pole. Photo: IATA

Participants noted the need for governments to issue more Letters of Authorisation (LoA) – a point also discussed at the International Civil Aviation Organization’s (ICAO) 42nd Assembly. LoAs are critical in ensuring that emissions reductions sold to airlines are not double-counted towards host countries’ own Paris Agreement Nationally Determined Contributions (NDCs). This is a key element for CORSIA to evolve from a policy framework for carbon-neutral growth to a functioning international market.

One enabler of CORSIA supply, insurance solutions to provide cover for LoA revocations, has recently taken a step forward with Gold Standard recently approving its first set of insurance policies, meaning an additional set of credits will soon become available beyond those from the Guyana ART/TREES programme [Update 05.11: Over 1.5mn cookstove credits can now also be used for CORISA following Gold Standard labelling the Malawi credits, from a biomass energy conservation programme, as CORSIA-eligible].

Futures pricing for CORSIA’s First Phase have been steadily increasing, reflecting the expectation of a significant rise in CORSIA-eligible carbon credit prices before the compliance deadline. IATA shared at the event that airlines are expected to spend up to $60bn on CORSIA-eligible credits until 2035.

The conference heard that Japanese companies are pushing for more supply to come online, engaging governments to authorise projects under Japan’s Joint Crediting Mechanism for CORSIA use. Airlines, rather than carbon project developers, will hold more influence when persuading governments to engage more quickly with the scheme, according to the panellists.

Airlines are getting ready for CORSIA takeoff

Airlines at WSS recognised the imperative to manage their CORSIA obligations. However, despite a preference to purchase credits from the places they fly to or the geographies they operate from, it’s important to note that credits can ultimately be sourced from any country and purchased by any airline participating in CORSIA.

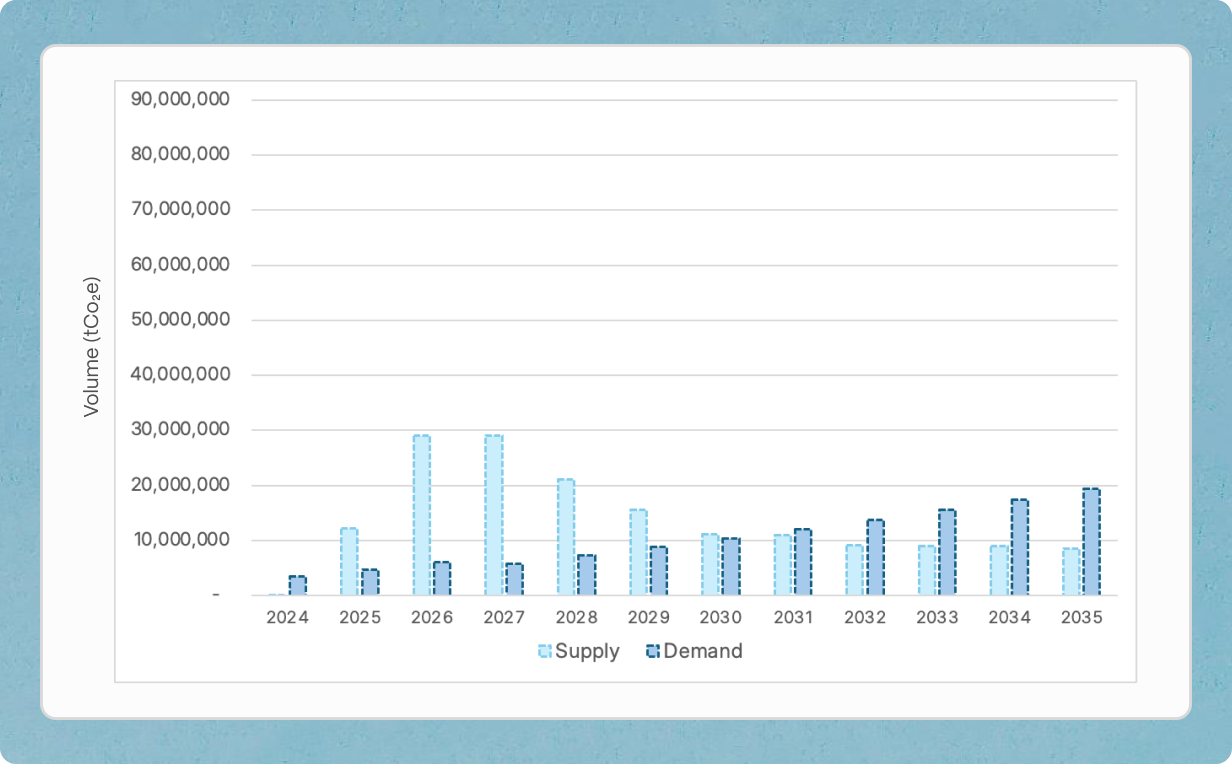

Some regions are relatively well balanced for supply and demand. For example, Figure 1 demonstrates Abatable forecasted CORSIA demand and supply requirements for 10 ASEAN Member States, where overall geographical forecasted supply and demand has a degree of commonality.

Figure 1: CORSIA supply and demand from the ASEAN Member States, Brunei, Cambodia, Indonesia, Laos, Malaysia, Myanmar, the Philippines, Singapore, Thailand, Vietnam. Timor Leste, which recently joined as a Member State, is not included in this forecast. Data: Abatable forecast

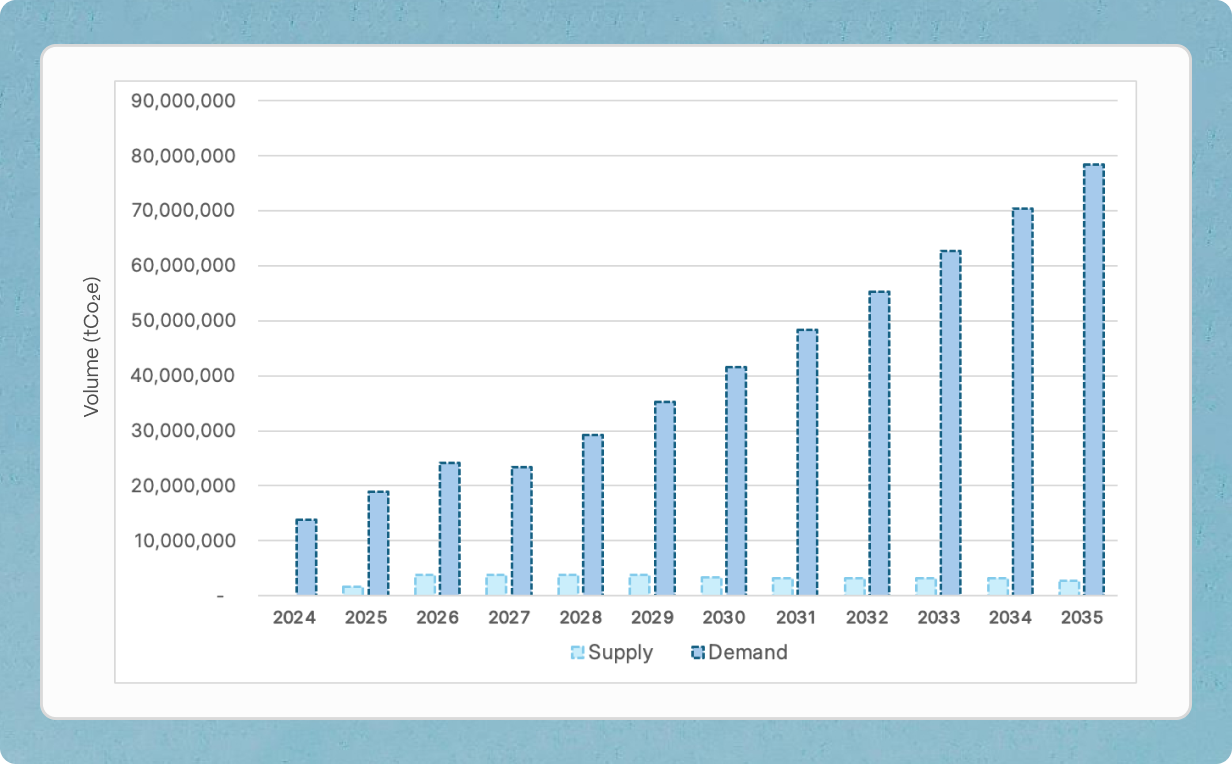

Figure 2, on the other hand, shows Abatable’s forecasted CORSIA demand and supply to 2035 from 10 countries in Asia, Europe, the Middle East and North America, including Canada, the UK, the UAE and Mexico. Here, demand significantly exceeds geographically available supply, meaning airlines from these countries will need to tap into the international market to secure credits.

Figure 2: CORSIA supply and demand from Azerbaijan, Canada, France, Chile, Greece, Mexico, South Korea, Switzerland, the UAE and the UK. Data: Abatable forecast

Airlines are up against a global set of buyers and, as previously discussed, supply is limited due to the time needed for projects to receive LoAs from their host governments and the timelines involved in eligible carbon credit registries approving insurance for credits.

Global demand may also ultimately be higher than initially expected, due to delays in the production of Sustainable Aviation Fuel (SAF).

As such, airlines are actively evaluating options and taking action. The two leading Japanese airlines ANA and JAL, for example, are the first retirees of CORSIA eligible credits (albeit of small volumes so far).

Sustainability teams should start preparing now

Airlines’ CORSIA obligations for the scheme’s First Phase may be in the hundreds of millions of dollars. While airline sustainability teams are responsible for defining CORSIA strategy, they must receive budget allocation from their finance teams and run through the purchasing processes managed by their procurement teams.

These partner departments are focused on minimising cost, reducing risk, and ensuring a robust process for competitive bids. They are not necessarily carbon experts, meaning that engagements must start and end with justifying expenditure and creating value for the airline.

Sustainability teams should work towards using mechanisms such as requests for proposals to gather multiple project offers, and be prepared to conduct diligence on those projects. Some may be able to do this themselves, particularly those with a strong track record in running their own voluntary carbon programmes. Others may need a partner, such as Abatable. But all are now in a position to start planning.

As compensation requirements are released from ICAO and more projects become available, it is a good time for sustainability teams to engage other business stakeholders to run through the practicalities of procuring CORSIA-eligible units.

Procurement models will expand as the market grows

At time of writing, there remains just one set of CORSIA-eligible credits, from Guyana. These credits can be purchased either from the trading house Mercuria directly – which has sole marketing rights – or through regular sales events run through the IATA ACE platform.

[Update 05.11: An additional 1.5mn cookstove credits can now be used for CORISA following Gold Standard labelling the Malawi credits, from a biomass energy conservation programme, as CORSIA-eligible, marking the second project worldwide to have issued approved units to date].

As more projects become available, airlines can consider a range of other procurement options:

- Competitive requests for proposals: Gathering offers from a range of developers, both those that are fully eligible (and tagged as such in the registry) or are close to becoming so.

- Structured offtakes: Going beyond simply buying issued-and-tagged credits and considering buying forward for delivery in the future, or using options for additional flexibility.

- Tying into broader sustainability goals: Integrating CORSIA alongside voluntary passenger offsetting programmes, purchases of innovative projects like direct air capture, or purchasing credits from the regions which the airlines fly.

CORSIA will run until at least 2035, meaning that investing in a robust approach to manage this long-term obligation will pay dividends.

Read more from our CORSIA series:

CORSIA unpacked: What does ICAO’s 42nd Assembly mean for addressing aviation emissions?

CORSIA compliance: Airlines need to offset 58 MtCO2 to cover 2024 emissions

Abatable’s procurement solutions, technical, policy and due diligence expertise can simplify meeting CORSIA compliance and help identify future streams of CORSIA supply. Contact us to learn how we can support your CORSIA compliance planning and procurement outcomes.