Alejandro Limón Portillo and Juan Carlos Arredondo Brun compare Abatable’s CORSIA demand forecasts to official estimates and explain the differences between modelling approaches.

CORSIA – the Carbon Offsetting and Reduction Scheme for International Aviation – is a global initiative designed to address and compensate for the growth of CO2 emissions from international civil aviation.

Under the market-based scheme, developed by the International Civil Aviation Organization (ICAO), airlines are obligated to use carbon credits to cover the growth of their emissions above a 2019 baseline. CORSIA takes a phased approach to stabilise aviation CO2 emissions relative to 2019, requiring the purchase of eligible credits approved by ICAO under the scheme.

Read more about how CORSIA works in the Abatable platform.

To assess airlines’ exposure to CORSIA, and to better understand the current and projected supply landscape, Abatable has developed a comprehensive annual forecast of the supply and demand of CORSIA-eligible carbon credit units to 2035.

Abatable’s model reproduces ICAO’s offsetting rules and eligibility criteria and conditions per phase, and includes the complete list of participating countries, all designated airlines, all international civil aviation routes covered by the scheme and the eligible carbon crediting programmes as published by ICAO.

Demand forecasts

Recent updates from key aviation bodies have provided new insights into expected demand for credits under CORSIA. From a regulatory angle, the Committee on Aviation Environmental Protection (CAEP) of ICAO produced an initial update of CORSIA analyses at the 232nd session of ICAO’s Council in June 2024, with interim assessments presented at the 234th session in March 2025.

The International Air Transport Association (IATA) has concurrently released its own demand projections, offering the industry perspective on compliance requirements.

Comparing Abatable’s forecasting outputs against these two authoritative organisations provides essential market validation. ICAO, as the United Nations agency responsible for developing CORSIA, represents the ultimate regulatory authority on the scheme’s implementation and requirements, making its demand projections an official benchmark for forecasting accuracy. Meanwhile, IATA represents around 350 airlines that account for over 80% of global air traffic.

This blog post outlines how Abatable’s forecasting outputs closely align with those of these two reputable sources, demonstrating the solidity and robustness of our analytical methodology and market intelligence capabilities. It explores how our demand estimates compare to these authoritative sources and explains what sets our methodology apart.

Abatable demand forecasting

Abatable’s CORSIA demand forecasting model uses a top-down approach where historical emissions data from over 13,000 international flight routes and 650 airlines* were captured and translated into three CORSIA demand scenarios over the scheme’s Pilot Phase (2021–2023), First Phase (2024–2026), and Second Phase (2027–2035).

The model uses official data from ICAO, which lists 129 participating countries as voluntarily participating in CORSIA’s First Phase. Earlier this month Viet Nam confirmed it will participate in 2026, bringing the total number of countries participating in the first phase to 130. Our modelling includes the addition of Viet Nam to First Phase demand totals.

As the market moves through CORSIA’s phases, from voluntary participation (Pilot Phase and First Phase) to mandatory (Second Phase), accurate demand forecasting becomes critical for airlines, carbon project developers and market participants planning their carbon credit procurement strategies.

To facilitate this, Abatable’s model bridges the gap between global projections and airline-specific offsetting requirements under CORSIA.

Forecasted CORSIA demand under the First and Second Phases

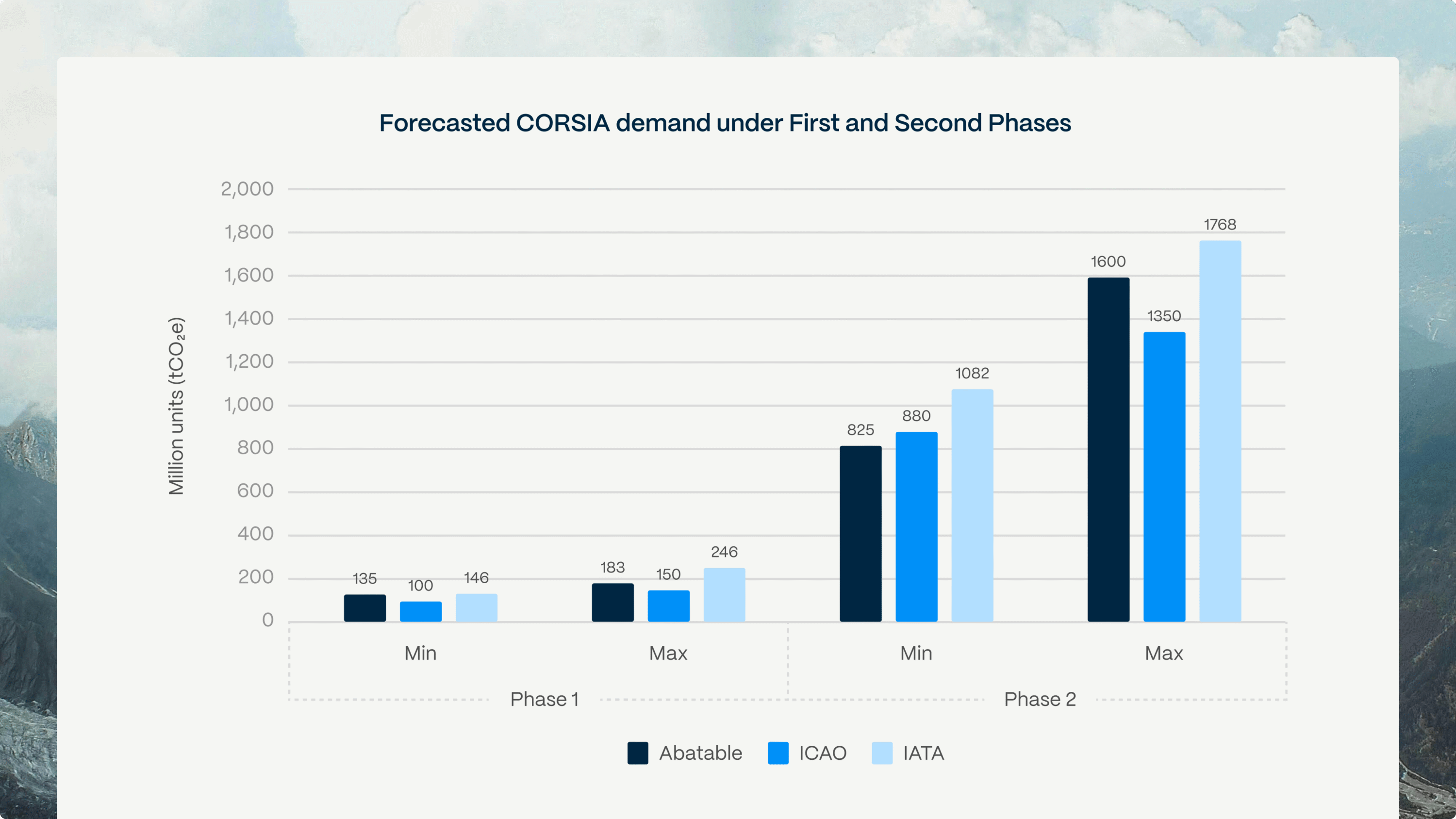

Figure 1. Forecasted minimum and maximum CORSIA carbon credit demand scenarios under the scheme’s First and Second Phase from Abatable, ICAO and IATA. Updated 10 September 2025 with new IATA demand forecast.

For CORSIA’s First Phase, the three forecasting approaches displayed in Figure 1 show some level of convergence. For the conservative estimates in the First Phase, Abatable’s is the most bullish, at 1.4 and 2.1 times larger than ICAO’s and IATA’s forecasts, respectively. Under the optimistic scenarios, the forecasts from the three organisations show more convergence – Abatable’s demand estimates are 1.2 times larger than ICAO’s, and 1.1 times larger than IATA’s.

CORSIA’s Second Phase will see the transition to mandatory participation for all ICAO parties. This creates more complex forecasting challenges due to varying assumptions about aviation growth and other variables including fuel efficiency improvements and sustainable aviation fuel (SAF) uptake.

These variables drive greater divergence in the three models, and also across each organisation’s scenarios. Abatable’s lower bound (825mn units) is slightly lower than ICAO’s (by 6%), and 24% lower than IATA’s. In the optimistic scenario, however, Abatable’s demand outputs sit between ICAO’s and IATA’s, at 19% larger than the former and 10% shorter than the latter.

Aggregate demand: A comprehensive market view

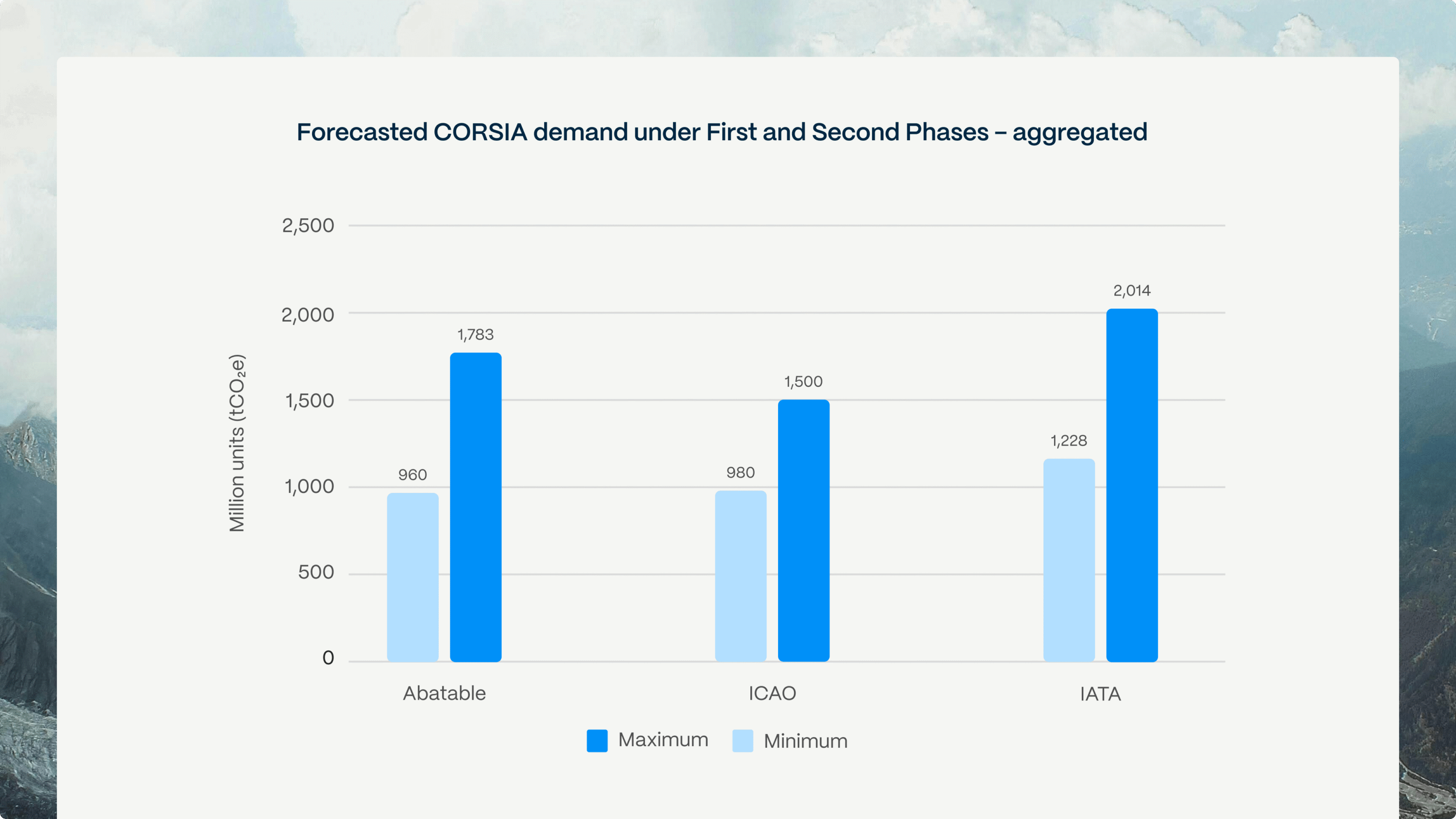

Examining total CORSIA demand across both phases allows further comparison, as seen in Figure 2.

Figure 2. Aggregated forecasted minimum and maximum CORSIA carbon credit demand scenarios under the scheme’s First and Second Phase from Abatable, ICAO and IATA. Updated 10 September 2025 with new IATA demand forecast.

Abatable’s aggregate demand forecast (961-1,782mn units) is strongly aligned with ICAO’s projections (980-1,500mn units). Abatable’s optimistic scenario is more bullish than ICAO’s, but both conservative estimates are virtually the same.

IATA’s forecasts are more bullish than Abatable’s and ICAO’s.

What sets Abatable’s forecasting apart?

Abatable’s supply and demand forecasts are noticeably narrower than those from elsewhere in the market, providing a proxy for consistency and reliability. This is demonstrated in the standard deviation of our outputs across different scenarios – a statistical measure that quantifies the degree of variation in the projected market balance (i.e. supply minus demand).

The standard deviation of Abatable’s CORSIA model is 23mn units, compared to 133mn units reported by other market competitors.

A key reason is our policy team’s differentiated insights into the pipeline of government Letters of Authorisation (LoAs) – a requirement for credit use in the CORSIA scheme. This, paired with our strong, ongoing relationships with project developers built through our carbon sourcing procurement services enable us to provide a more precise and up-to-date view of CORSIA-eligible supply.

In addition, Abatable’s modelling offers:

1. Airline-level granularity

While ICAO and IATA provide essential global and regional perspectives, Abatable’s model translates these macro trends into airline-specific CORSIA compliance requirements. Our platform can tell individual airlines exactly how many CORSIA units they’ll need to retire each year, accounting for their specific route networks.

2. Supply/demand matching intelligence

Beyond demand forecasting, weekly updated supply intelligence is integrated into Abatable’s platform, helping airlines identify where they can source CORSIA-eligible credits based on their preferences for geography, project type, vintage and pricing.

This procurement-focused approach addresses the critical gap between understanding demand and securing supply.

3. Dynamic scenario modelling

Our forecasts incorporate multiple scenarios for key variables:

- Aviation traffic recovery patterns after COVID-19; and

- The number of countries participating in the scheme throughout the different phase

4. Real-time market intelligence

Abatable’s forecasts are continuously updated based on:

- ICAO eligibility decisions for carbon crediting standards

- Actual airline emissions reporting data

- Market supply developments and project pipeline analysis

- Policy changes in host countries affecting credit availability

5. Interactivity

Our model and airline-specific demand mapping are fully accessible through the Abatable platform, with interactive features allowing users to apply filters and scenarios to interrogate our data to fit their needs.

Conclusion

While ICAO provides the regulatory framework and IATA offers the industry perspective, Abatable bridges the gap between global projections and individual compliance needs. Our forecasts align closely with these authoritative sources while providing the granular, actionable intelligence that airlines need for effective CORSIA compliance.

The convergence of overall CORSIA demand estimates at around 1-1.8bn units provides market confidence and validates CORSIA’s role as a major driver of carbon credit demand. However, successful compliance requires more than aggregate forecasts, it demands airline-specific planning, supply chain intelligence and procurement expertise.

As the CORSIA market continues to evolve, Abatable remains committed to providing the most accurate, actionable, and procurement-ready market intelligence available to navigate the scheme.

For more insights on CORSIA market dynamics and procurement strategies, sign up to Abatable’s market intelligence platform. Contact our team to learn how our airline-specific forecasting can enhance your compliance planning and procurement outcomes.

*Airline emissions are covered up to October 2024 (as per Part III of CORSIA’s Central Registry). CORSIA Aeroplane Operator to State Attributions reports 670 as it was updated in December 2024.