The Paris Agreement’s Article 6.4 bridges the gap between voluntary and compliance markets, creating potentially unprecedented opportunities for climate finance. In this final instalment of our three-part Article 6.4 series, we explore how the mechanism intersects with existing carbon markets and what this means for carbon project investors.

The fundamental commercial consideration for the Paris Agreement Crediting Mechanism (PACM) is that, while it has made considerable progress over the past year, it is still not fully operational. Despite this, the potential market is substantial, with Article 6.4 positioned to become a cornerstone of international climate finance.

The mechanism could significantly reduce the cost of implementing Nationally Determined Contributions (NDC) by more than half by 2030, potentially enabling countries to increase their climate ambition. This cost-effectiveness creates a compelling value proposition for countries looking to meet their Paris Agreement commitments efficiently.

Integration with the VCM

The PACM and its units could potentially coexist and operate in connection with the voluntary carbon market (VCM), but in a more structured way than the Clean Development Mechanism (CDM).

Following clarifications made at COP29, carbon project host countries now have three distinct options for managing Article 6.4 emissions reduction units (A6.4ERs):

- Fully authorise the units (requiring corresponding adjustments);

- Explicitly decline authorisation; or

- Issue units as ‘Mitigation Contribution Units’ (MCUs).

A6.4 MCUs can be traded internationally without a corresponding adjustment, similar to today’s voluntary trading.

While this framework technically allows for VCM participation, it’s important to understand that PACM’s primary purpose is to support international cooperation and NDC fulfilment under the Paris Agreement. As a UN-governed mechanism with countries as the main stakeholders, PACM is likely to prioritise authorised units for use toward NDCs and other international compliance purposes over VCM applications.

Projects seeking to generate units primarily for the VCM may find the MCU pathway most relevant, though this would mean their units cannot be used toward NDCs or other international mitigation purposes. Stakeholders should carefully consider these authorisation implications when deciding whether to pursue PACM registration, as the mechanism’s governance structure and emphasis on supporting national climate goals may make it less flexible and more time-consuming than existing VCM standards.

CORSIA linkage potential?

PACM’s path to potential CORSIA eligibility is becoming clearer as the mechanism comes to life. In September 2025, a letter from the Chair of PACM’s Supervisory Body to the International Civil Aviation Organization’s (ICAO) council signalled that they’re ready to collaborate.

The PACM team has requested early guidance from ICAO on allowing PACM credits into CORSIA, which could ease supply constraints in the international aviation offsetting scheme. However, formal eligibility remains contingent on completing ICAO’s assessment process. ICAO’s Technical Advisory Body has indicated it will evaluate PACM units once they’re ready for eligibility review, with the process appearing to advance prior to COP30.

While PACM is being designed with high environmental integrity standards (including robust MRV systems and safeguards against double counting), it must demonstrate full operational capability and a track record before formal approval.

For project developers, this means PACM units aren’t yet CORSIA-eligible, but the timeline looks more promising than previously anticipated.

Country-specific approaches

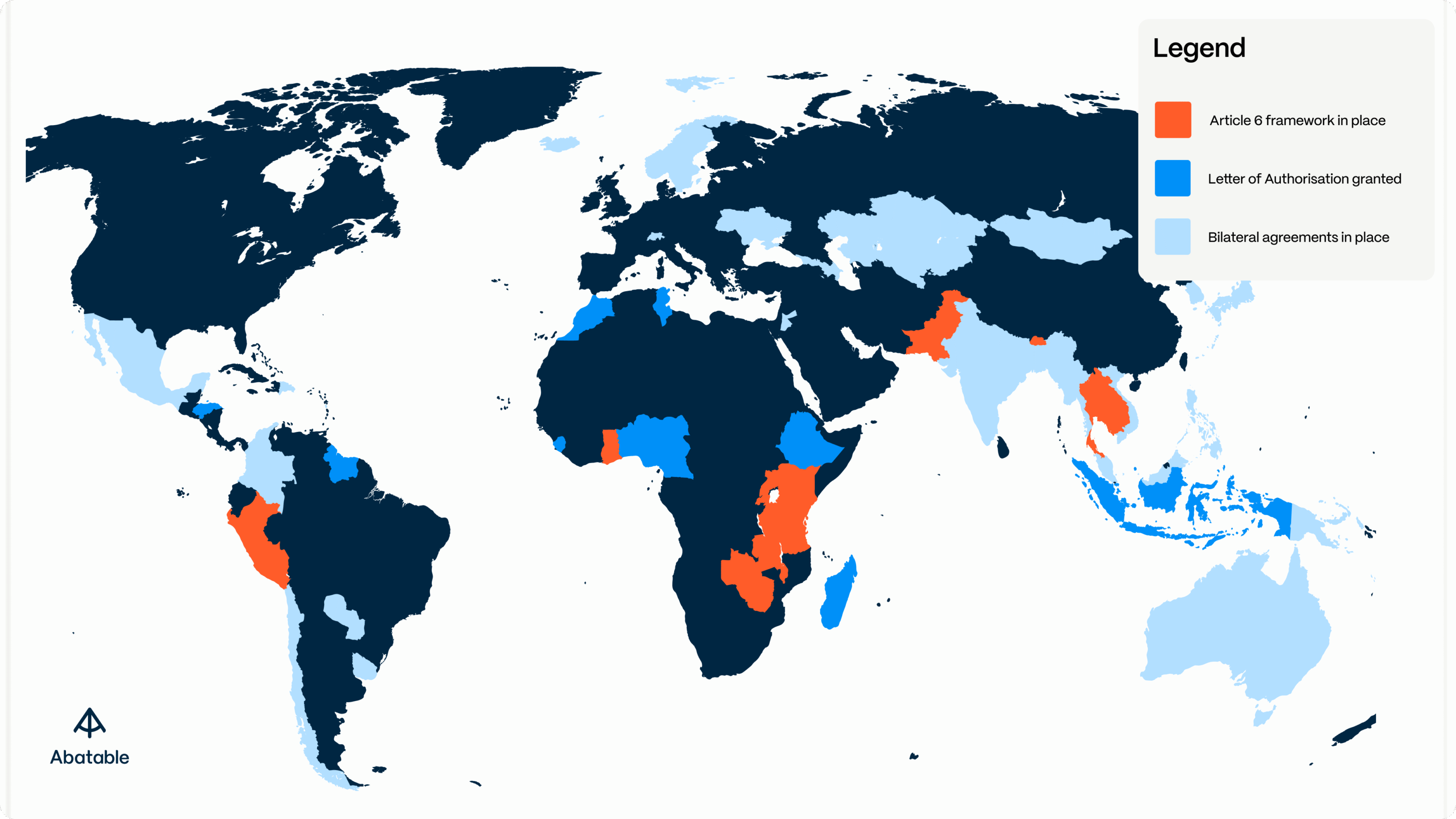

Countries are taking varied approaches to Article 6.4 engagement, with some pioneering early adoption. The global map of carbon market engagement shows different levels of preparedness and interest across regions, with some countries already having established Article 6 frameworks, granted Letters of Authorisation, or developed bilateral agreements (see Figure 1).

This varied landscape means that project developers and investors need to assess country-specific conditions carefully before investing. Countries with clear Article 6 frameworks, designated national authorities, and identified sectoral priorities will offer more predictable environments for project development.

The future of Article 6.4: A bridge to integrated carbon markets

The emergence of PACM marks a pivotal moment in the evolution of carbon markets, bringing both exciting opportunities and new considerations for market participants.

First, we’re seeing the dawn of a new class of carbon credit. Starting in 2025, A6.4ERs will introduce a UN-backed crediting system that bridges voluntary and compliance markets. This isn’t just another standard, it’s a fundamental shift in thinking about carbon credits, offering both authorised units (with corresponding adjustments) and MCUs that support host countries’ goals and enhance their climate ambition.

PACM’s success will largely depend on methodological robustness and market adoption. While building on lessons from the CDM and incorporating modern market innovations, A6.4ERs will still require careful due diligence, especially given that the first credits issued by the mechanism will be those transitioning from the CDM – the vast majority of which are from renewable energy projects.

The implications for pricing and demand are significant. As voluntary and compliance markets converge, A6.4ERs are positioned to command premium prices, reflecting their unique status and robust governance. Countries like Singapore are already showing how carbon credits can be integrated into national compliance systems, and this trend is likely to accelerate.

Looking ahead, PACM represents more than just a new crediting mechanism; it’s a bridge to a more integrated carbon market. For project developers and investors, this means new opportunities but also the need for careful strategic positioning. Success will require understanding not just PACM’s technical requirements, but also the broader context of how carbon markets are evolving under the Paris Agreement.

Read more from our Article 6.4 series:

01 – Article 6.4 explained: The Paris Agreement Crediting Mechanism state of play

02 – Getting ready for Article 6.4: Practical steps for carbon projects

You can also explore our Article 6.4 theme in the Abatable Platform.

To understand more about how to approach Article 6.4 from a supply or demand perspective, get in touch to speak with one of our experts.