Abatable’s latest report outlines nine lessons from how leading companies in the voluntary carbon market procure carbon credits. This article provides a handy summary of the learnings.

How to go about buying carbon credits is an increasingly important part of corporate sustainability strategies. With climate mitigation more urgent than ever, businesses are starting to look beyond ‘low-hanging fruit’ decarbonisation options, turning to tools like carbon credits to support additional climate action.

Done well, buying high-quality carbon credits accelerates climate change mitigation and directs vital finance into projects with global impact. Done poorly, it can lead to wasted time, unnecessary costs, and potential reputational risk.

Abatable has supported more than 200 corporate buyers on their carbon credit journeys, sourcing over one billion tonnes of CO2 and transacting 55 million tonnes of high-quality carbon credits. From this experience, we’ve identified nine practical lessons that leading buyers apply to build credible, high-impact carbon offset strategies.

Below, we highlight the key takeaways from our latest report, What leading carbon credit buyers do differently.

For full insights, detailed examples, and case studies, you can download the complete report here.

Lesson one: Educate your stakeholders

The challenge

Carbon credit procurement is not like buying other commodities. Credits vary widely in type, methodology, impact, and price. Without internal understanding, processes can stall, risks can rise, and value can be lost.

The learnings

Leading buyers invest early in educating sustainability, finance, procurement, legal, and even C-suite teams on how the voluntary carbon market (VCM) works. Some run pilot procurements to build fluency before scaling up. The better your team understands the voluntary VCM, the smoother and more effective your carbon procurement strategy will be.

Lesson two: Be transparent in scope and strategy

The challenge

Project developers need clarity. Responding to buyer requests for proposals takes time, so clear asks can save valuable resources for both sides. The most effective buyers are explicit from the get-go about non-negotiables, preferred project types, and sustainability goals.

The learnings

Transparency saves time and builds trust. Developers are increasingly looking for partners who align with their mission, and by communicating your broader carbon credit strategy, you’ll receive stronger, better-aligned proposals.

Lesson three: Balance cost, risk, and impact

The challenge

In carbon procurement, you rarely find credits that are low-cost, low-risk, and high-impact all at once. Buyers can often set rigid criteria, and then struggle when no one project meets them.

The learnings

Leading buyers recognise the trade-offs. For example, nature-based solutions can deliver biodiversity and community co-benefits but carry higher permanence risks; engineered removals offer durability but at a premium. Using benchmarking and expert advice helps companies strike the right balance for their climate and procurement goals.

Lesson four: Treat developers as partners, not suppliers

The challenge

Treating developers purely as vendors closes the door to innovation and flexibility.

The learnings

Buyers who approach developers as long-term partners see better outcomes. Developers may adjust credit issuance timelines, restructure terms, or scale projects when they see credible commitment. By engaging early, sharing feedback, and asking ‘what’s possible?’, buyers unlock better outcomes for themselves and help raise quality across the market.

Lesson five: Time your procurement wisely

The challenge

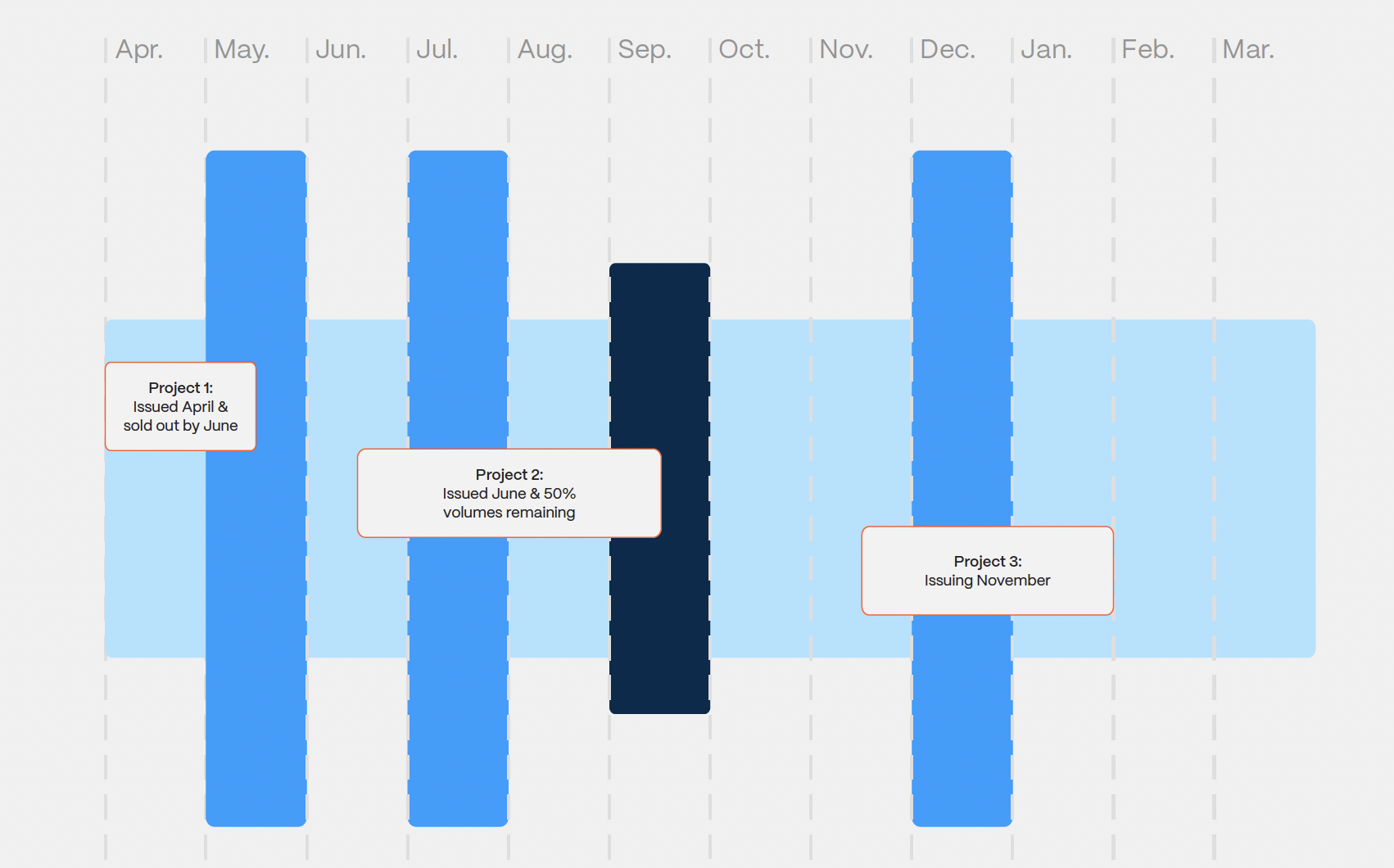

Many companies buy credits only once a year, post-emissions accounting. This locks them into the spot market and risks missing the highest-quality projects.

The learnings

Strategic buyers plan earlier, run multiple procurements across the year, or adopt a continuous sourcing approach. They also use forward, option, or offtake contracts to secure long-term access.

Moving from single yearly (dark blue) to multiple procurements (light blue) or continous sourcing (very light blue) results in more project opportunities

This proactive approach ensures access to the right credits, not just the credits that happen to be available.

Lesson six: Define and communicate your due diligence

The challenge

Due diligence is essential but resource-heavy. With clarity on what will be assessed, project developers are more likely to submit projects that are more likely to meet requirements, saving time all around.

The learnings

High-performing buyers outline due diligence frameworks in advance – communicating required information, what will be reviewed, and when. This transparency attracts better-fit proposals, accelerates procurement, and signals credibility to the market.

Lesson seven: Align credit hold windows with your process

The challenge

Asking developers to hold credits for months while internal approvals drag on harms both sides. Buyers risk losing access to good projects, and developers risk missing other revenue opportunities.

The lesson

Leading buyers streamline approvals, align decision-making with procurement timelines, and communicate clear timelines to sellers. This improves participation rates and positions the buyer as a fair, reliable partner, strengthening relationships.

Lesson eight: Run retrospectives

The challenge

Once credits are purchased, many teams often move straight on. But failing to reflect means missing valuable lessons that could improve future procurement.

The learnings

Leading buyers conduct structured retrospectives, recording what worked, what didn’t, and how to improve. This builds internal playbooks, accelerates decision-making, and strengthens cross-team alignment. Externally, it signals professionalism and builds credibility with project developers.

Lesson nine: Share feedback to strengthen the market

The challenge

Without feedback, project developers have little insight into why offers succeed or fail, limiting their ability to adapt.

The learnings

Forward-thinking buyers share anonymised insights on why projects were or weren’t selected. This not only improves future offers but also positions the buyer as a collaborative, trusted market participant, resulting in better projects, stronger relationships, and a healthier carbon procurement market overall.

Why this matters

The voluntary carbon market is a powerful lever for advancing corporate climate goals. But navigating it successfully requires careful strategy, not just transactions. The nine lessons above show how companies can move from ad hoc buying to a structured carbon credit procurement strategy that balances cost, risk, and impact while unlocking real-world climate solutions.

Abatable has built the infrastructure to help businesses put these lessons into practice – from strategy design and sourcing to due diligence, contracting, and reporting. Whether you’re just beginning or looking to refine your approach, we can help you create a carbon credit procurement solution that delivers greater impact, faster.

For more detail and to see case studies of leading buyers putting these lessons into action – download the full nine lessons report here.