Fully structured carbon credit procurement exercises take time – and rightly so. From project types to impact profiles, there’s a lot to consider. But for companies looking to secure high-quality credits without committing to a full RFP (Request for Proposal) process, a carbon credit RFQ (Request for Quotation) offers a faster, more focused alternative.

The voluntary carbon market (VCM) continues to evolve. Many companies using it to support climate action can find themselves caught between competing priorities: comprehensive due diligence versus speed to credit retirement.

As 2030 net-zero milestones loom, the race is on to meet decarbonisation deadlines and lock in procurement cycles to support climate and sustainability strategies.

However, when procuring carbon credits, deciding between thoroughness and efficiency is not a binary choice. While comprehensive RFPs are a central pillar of carbon credit procurement, there’s another approach that can deliver high-quality credits within one to three weeks: strategic RFQs.

Meet the RFQ: The RFP’s faster, more efficient cousin

Traditional RFP processes excel when building long-term carbon credit programmes, exploring new project categories, or making substantial volume commitments that justify extensive vendor evaluation. These comprehensive approaches allow comprehensive assessments of carbon project developer and supplier capabilities, detailed project due diligence, and thorough contract structuring.

For companies establishing carbon credit strategies or making significant multi-year commitments, this investment often pays dividends in supplier relationships, prices unlocked, and risk management.

But not every carbon credit procurement requires this level of analysis. When you have clear requirements, established quality criteria, and a need to move efficiently, RFQs offer a sound alternative. Investing some upfront time in defining what you need and identifying who can deliver it allows a focus on comparing specific carbon credit offerings against predetermined criteria.

In addition, running a full RFP can be a fairly daunting prospect and so buyers can default to purchasing the same credits from the same suppliers they’ve used in previous years. This can be a suboptimal approach – buyers may not get the best pricing or projects for their needs. RFQs provide a helpful middle ground to refine strategies year-over-year without needing to run an overly complex carbon procurement process for your current needs.

When to choose RFQs over RFPs

RFQs work best when you are clear on your requirements and have access to pre-qualified suppliers. They’re particularly effective for:

- Annual top-up credit purchases to meet sustainability targets

- Repeat purchases of familiar project types

- Situations where speed-to-market matters more than extensive supplier evaluation

- Organisations with internal carbon credit expertise that can efficiently evaluate technical specifications

- Organisations working with a trusted vendor and pre-vetted, de-risked credits

The RFQ approach can deliver quality credits faster, at predictable prices. This results in meeting targets with efficiency that satisfies finance teams and the C-suite.

RFPs of course remain a cornerstone of strategic procurements where additional time investment delivers proportional value in market exploration, supplier relationships, risk mitigation, and contract flexibility.

Building your foundation: Know what you want before running an RFQ

Great RFQs start with great preparation.

Establish clear criteria for additionality, permanence, and co-benefits upfront. Maybe that means certain registries or certifications only, or vintages within the last three years, or projects that deliver measurable community benefits. Whatever these standards, lock them down early and evaluate against them in the RFQ process.

Budget realism matters more in carbon markets than most commodity purchases. Prices vary dramatically by project type, geography, and market timing. Understanding price ranges before launching your RFQ prevents awkward budget conversations later and helps you target appropriate project types.

Explore carbon credit prices in the Abatable platform.

Designing carbon credit RFQs that work

Carbon credit RFQs aren’t your standard procurement documents – they need to address the unique characteristics that make these credits different from every other commodity your team buys.

Technical specifications matter enormously because carbon credits represent complex environmental projects, not physical goods. Your RFQ should specify required methodologies, monitoring protocols, and verification standards. But resist the temptation to over-specify. Focus on outcomes (verified emission reductions with clear additionality) rather than prescribing exactly how suppliers achieve them.

Pricing structures require particular thought in carbon markets. Unlike steel or grain, carbon credits carry various risk factors that influence cost. Consider requesting both spot pricing for immediate delivery and forward contracts for future needs. Consider volume tiers that reward larger commitments without locking you into inflexible arrangements.

Project and partner selection

The carbon market is a complex global ecosystem of carbon projects, each with distinct approaches, methodologies, risks and benefits. Understanding project differences will help you build the criteria to maximise your RFQ success.

It’s a good idea to focus pre-qualification criteria on capability rather than just credentials. Look for carbon project developers with proven track records delivering credits matching your specifications. It can be pertinent to look beyond well-known projects – smaller specialists often outperform larger generalists for specific requirements.

Given the complexity of the carbon market, working with a trusted third-party partner can unlock the best results when running an RFQ. When deciding on a partner, look for their breadth of market access, relationships with carbon project developers, and their approach in helping you select the projects that best fit your mandate – rather than just the ‘top’ projects in their portfolio.

Working with a partner can really help hone your specifications, which matters enormously because carbon credits represent complex environmental projects, not physical goods. Your RFQ should specify required methodologies, monitoring protocols, and verification standards. It should also focus on outcomes (verified emission reductions with clear additionality) rather than prescribing exactly how suppliers achieve them.

Pricing structures require particular thought in carbon markets. Unlike other commodities, carbon credits carry various risk factors that influence cost. Consider requesting both spot pricing for immediate delivery and forward contracts for future needs. Consider volume tiers that reward larger commitments without locking you into inflexible arrangements.

Finally, market timing can make or break your RFQ results. Carbon credit demand peaks in Q4 as companies scramble to meet annual targets, while supply often increases following seasonal project verification cycles. Avoiding the Q4 rush could unlock better pricing and credit availability while avoiding year-end market pressures.

The Abatable platform can facilitate fast RFQs from projects that have already submitted relevant details for quick comparisons. Book a demo to find out more.

Streamlined evaluation that maintains quality

RFQ evaluation success depends on clear, quantifiable criteria that enable rapid comparison without sacrificing quality considerations. Unlike comprehensive RFP scoring that might include dozens of weighted factors, effective carbon credit RFQs focus on what truly matters: price, quality, delivery reliability, and strategic alignment.

This means considering tradeoffs between costs, risks and impact when setting criteria, and setting a framework to enable comparisons without sacrificing quality. Reviews can then be focused on supplier credibility, contract terms, and delivery capability.

Teams can underestimate the internal expertise required for successful carbon credit procurement. Consider engaging strategic support for market intelligence, supplier evaluation, and contract negotiation guidance, particularly for initial procurements or when entering new project categories.

Abatable works with carbon credit buyers to define their criteria and strategy. Speak with our team to find out more.

A final option: run an RFI

If you have a strong handle on your requirements and are simply looking for availability and price benchmarks on specific carbon project types, an RFI (Request for Information) may be an even quicker option.

For companies facing truly urgent timelines, RFI processes can offer the fastest route to market. RFIs work by leveraging suppliers’ existing inventory of pre-verified credits, eliminating the time needed for project evaluation or contract customisation. You’re essentially asking: ‘What do you have available now that meets these basic criteria?’

The trade-off is reduced customisation and potentially higher prices, as you’re accessing suppliers’ readily available stock rather than optimising purchases around your specific requirements. However, RFIs excel when speed absolutely trumps everything else, or when you’re doing market reconnaissance before launching a more structured RFQ or RFP process.

RFIs also work well for spot purchases – filling small gaps in your carbon portfolio or taking advantage of market opportunities when high-quality credits become available at attractive prices. Sophisticated buyers use RFIs tactically while running longer-term RFQ or RFP processes for their core requirements.

Abatable facilitates RFIs through its platform, with a host of engaged project developers offering rapid responses to buyers’ RFI requests. Book a demo to find out more.

Moving forward: choosing your approach

RFPs, RFQs and RFIs all have their place in strategic carbon credit procurement. The key is matching your approach to your specific situation and objectives.

Well-executed RFQ processes prove that speed and quality aren’t mutually exclusive when you have clear requirements and established quality standards. They’re particularly powerful for organisations that have moved beyond initial carbon credit exploration and want efficient access to familiar project types.

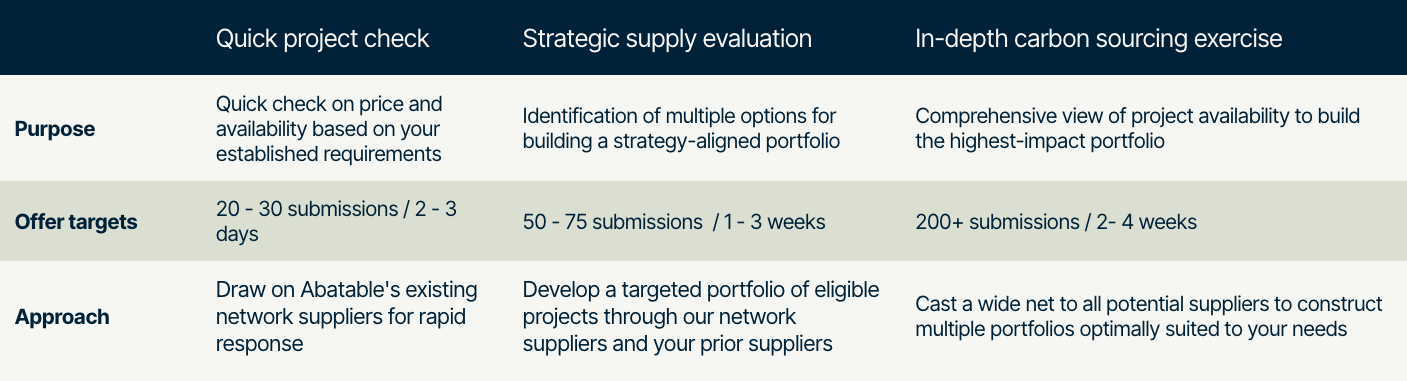

Abatable offers flexible carbon sourcing solutions across RFIs, RFQs and RFPs, ranging from quick, cost-conscious approaches to more thorough market sourcing exercises to generate more project submissions over a longer time frame. Abatable works with companies to identify the best approach for their needs.

For companies still developing their carbon strategies or making substantial long-term commitments, comprehensive RFP processes provide the thorough evaluation that justifies their longer timelines.

This isn’t about compromising standards or rushing decisions. It’s about recognising that different procurement situations call for different approaches, and smart organisations maintain flexibility in their toolkit.

Your next carbon credit procurement can be faster, better, and more strategic. Whether you choose an RFP, RFQ or RFI approach, the frameworks and principles outlined here can help optimise your process for your specific needs and timeline.

Abatable has developed solutions to support companies at any stage of their carbon credit procurement process, whether through RFPs, RFQs, or RFIs. Contact our team to find out how we can help you approach the carbon market and meet your procurement needs more efficiently.

Read the other articles in our corporate buyers series:

- Navigating carbon credit integrity: What every buyer needs to know

- How to approach carbon credit claims confidently in a rapidly evolving market

- How to talk to your CFO about your carbon budget

Finally, read more on how leading carbon credit buyers approach the market in our latest report, What leading carbon credit buyers do differently.