New Abatable analysis finds that the minimum floor price for REDD+ carbon credits under new, higher-integrity methodologies is at least $15. As Dr Peter Wooldridge writes, carbon credit buyers should move away from existing, outdated price benchmarks for REDD+ to support the new era for high-quality forest-based carbon emission avoidance.

The voluntary carbon market (VCM) has experienced a push toward greater integrity in recent years, particularly in the REDD+ and cookstoves sectors, where new methodologies, monitoring procedures and technologies are providing better assurance of genuine climate impact.

These developments – while welcome – also drive up implementation costs for carbon credit projects, the implications of which have not been fully assessed.

In a new analysis, Abatable has assessed the cost of delivering high-quality REDD+ carbon credits in the new carbon credit supply landscape. We find that carbon credit buyers should expect to pay a minimum price of $15 for high-quality REDD+ credits, rising to $35 under our conservative scenario.

A new methodology for REDD+ carbon credits

REDD+ projects, designed to prevent deforestation and forest degradation, have recently faced credibility issues due to some inflated assumptions on the baseline levels of deforestation in project areas. These overstated threats have had the result of damaging confidence in the voluntary carbon market (VCM).

To restore trust, VCM standard bodies like Verra have introduced stricter methodologies, most notably VM0048 which was launched in 2023. VM0048 applies jurisdictional deforestation risk maps, shortens baseline reassessment periods from ten to six years, and removes developer discretion from baseline setting – key steps to improving credit integrity and reducing risks of over-crediting.

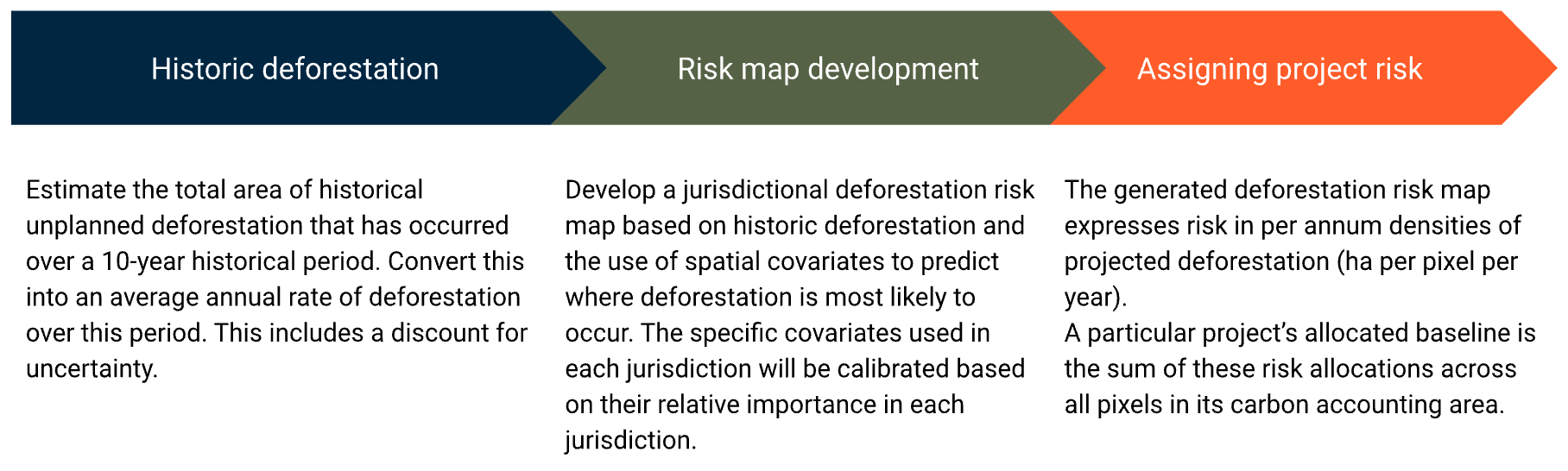

All new REDD+ projects registered with Verra must now use VM0048, with older methodologies now being phased out. The new framework standardises assumptions using jurisdiction-wide (national or sub-national) historical deforestation data, converted into projected annual rates and mapped spatially (see Figure 1).

Figure 1. Summary of deforestation risk maps creation by Verra.

This shift removes the discretion of individual developers when defining baselines as the methodology mandates the use of independent, high-quality data service providers for jurisdictional baseline data. It increases transparency and reduces the risk of manipulation in baseline settings, theoretically leading to more conservative credit issuance.

By taking ownership of the baseline setting process and standardising the approach to REDD+, Verra is closing baseline loopholes that have previously been exploited. Consequently, VM0048 is more conservative than prior approaches and is likely to result in substantial reductions in credit issuances from REDD+ projects.

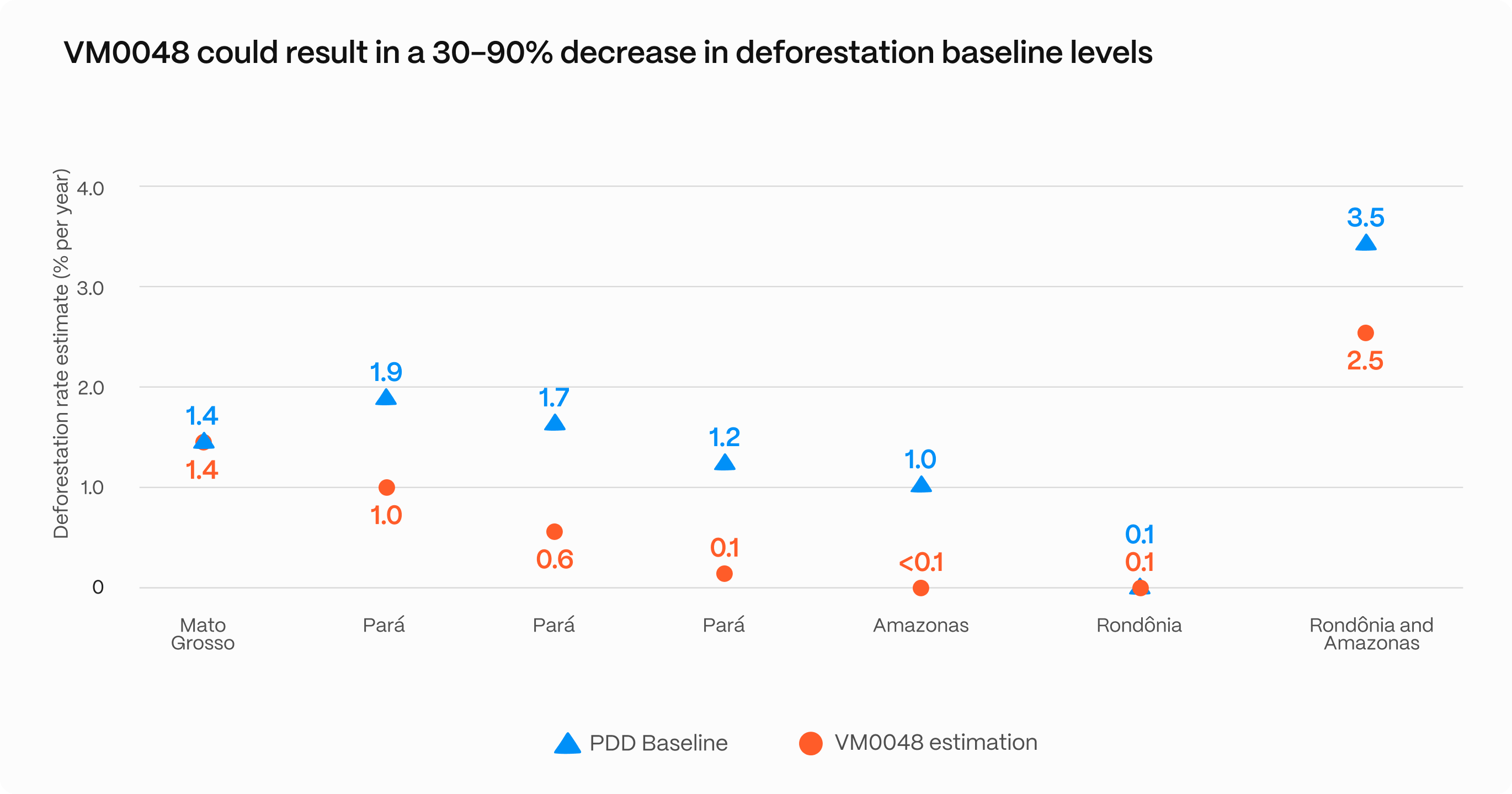

Under VM0048, our modelling indicates emissions avoidance estimates could be 30 to 90% lower, depending on the reference region, as a result of more accurate deforestation rates assumed in carbon credit calculations.

Figure 2 demonstrates the potential impact of VM0048 on the baseline rate of deforestation for a selection of REDD+ projects located in Brazil.

Figure 2. Average baseline deforestation rates in Project Design Documents (PDD) for projects located in Mato Grosso, Pará, Amazonas, and Rondonia, Brazil, against their estimated deforestation rates under VM0048. Estimates under VM0048 are forecast based on freely available 2019–2024 Verra risk maps (resolution 100m x 100m pixels).

$15 – the new credit floor price for forest conservation

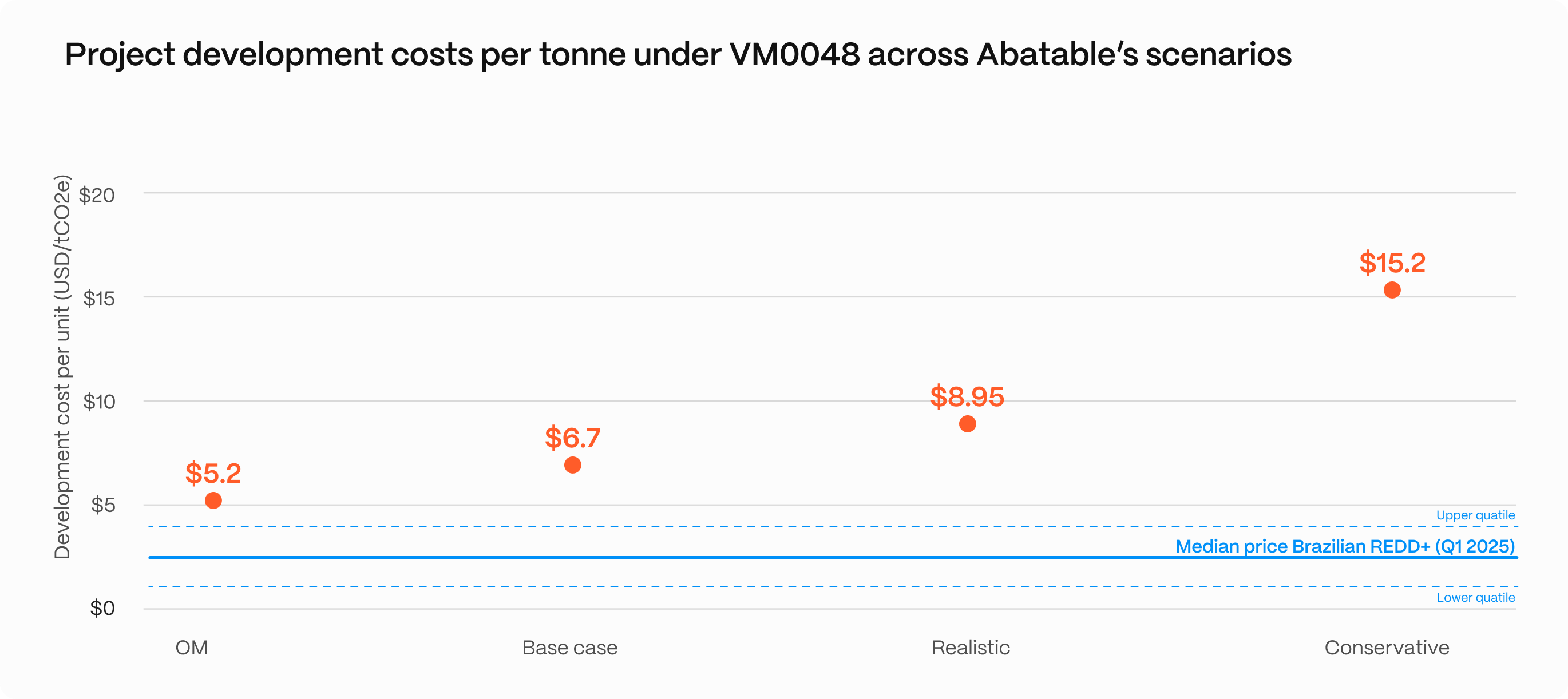

To assess the financial feasibility of REDD+ projects under VM0048, we modelled a 50,000-hectare REDD+ project in Pará under various baseline scenarios.

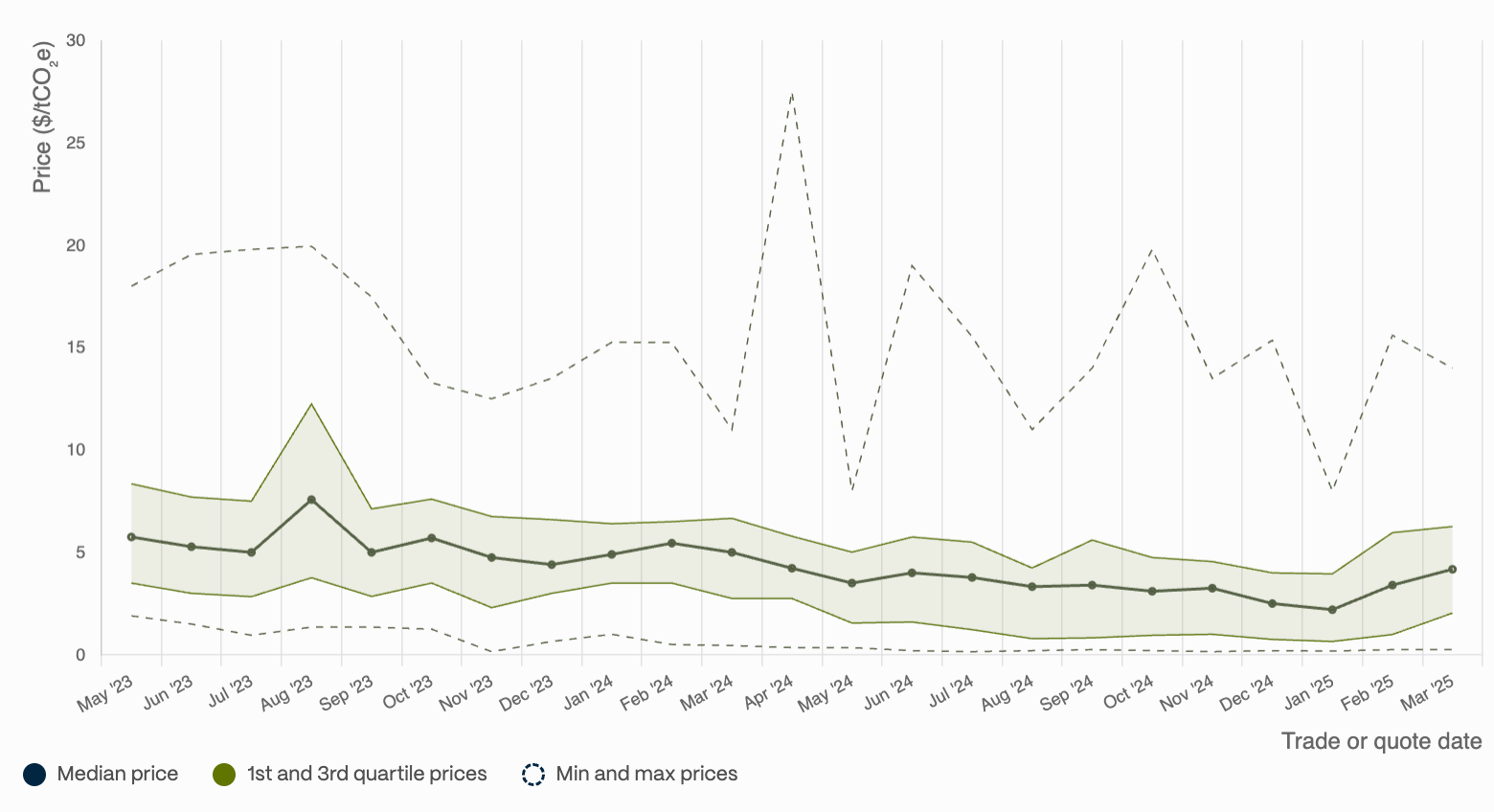

Our results indicate new development costs for carbon avoidance credits under the VM0048 methodology are between $6.7 and $15.2 per carbon credit (see Figure 3) – two to six times higher than current spot prices transacted in the market. The median price for Brazil REDD+ carbon credits was $2.5 per unit as of the end of Q1 2025.

The transition to VM0048 thus has a significant, detrimental impact on the financial attractiveness of REDD+ projects and under no scenario can a project be profitable under current spot market conditions.

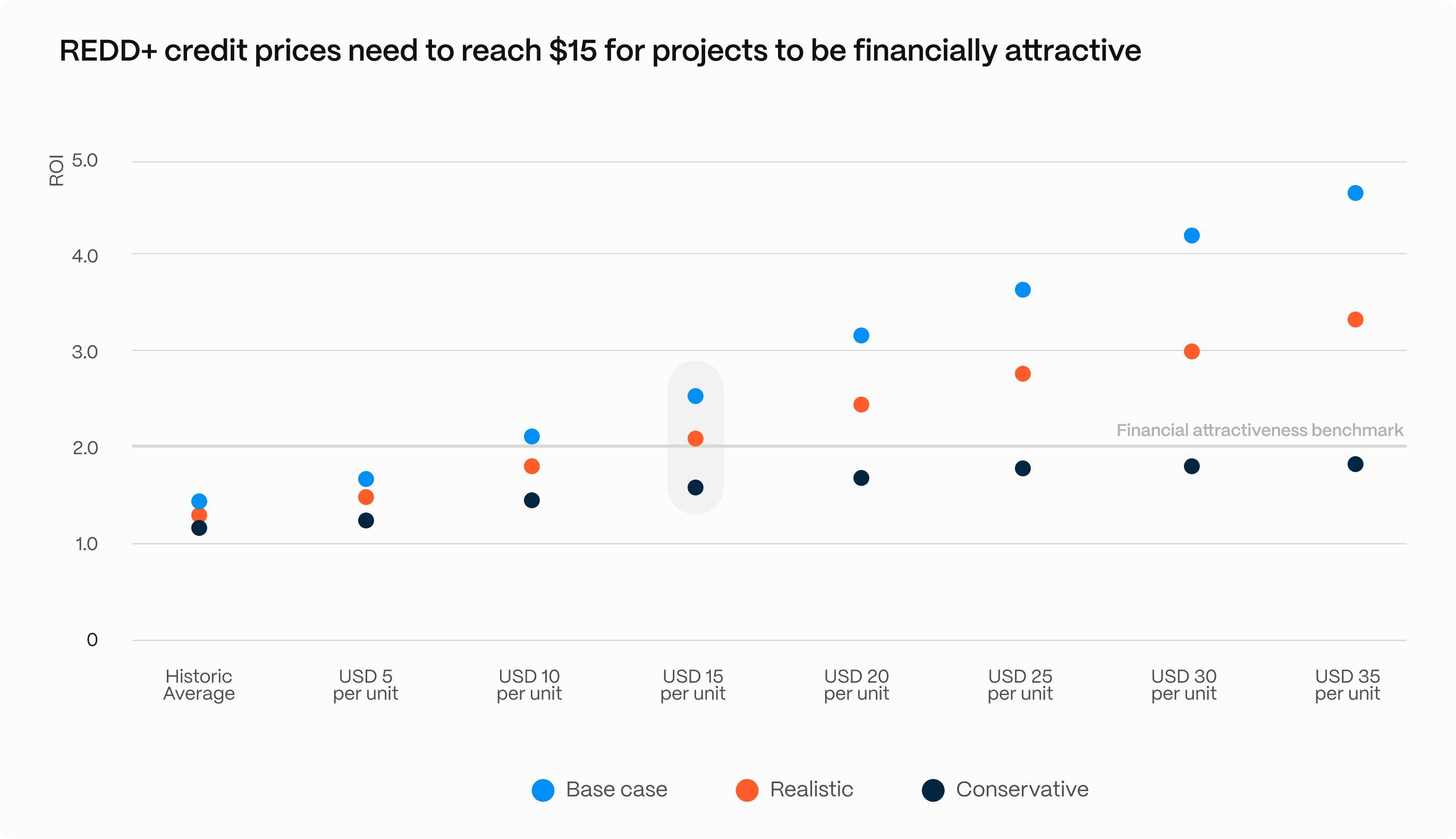

To assess how much market prices would need to rise for our hypothetic project to remain financially attractive and thus viable, we modelled a hypothetical return on investment on the production costs of each credit (Figure 4).

We find that, under a realistic scenario, our project would have to attain a credit price of over $15 to reach our financial attractiveness benchmark of at least 2X ROI. Meanwhile, under the conservative scenario, credit prices will need to reach over $35 per unit to reach a level of investment attractiveness for institutional investors.

Figure 3. The development cost for a single verified carbon unit or credit generated across all scenarios in Abatable’s financial analysis. OM represents costs under the old methodology and assumes no transition to VM0048.

Figure 4. The impact of different pricing on the ROI of the project under VM0048 scenarios. The transition scenario has also been modelled at different $5 intervals.

Market implications: REDD+ must reprice or restructure

The financial impact of VM0048 could reshape the REDD+ landscape. Many projects will become unviable unless prices rise sharply – from the current median spot price of $3.5 to over $15.

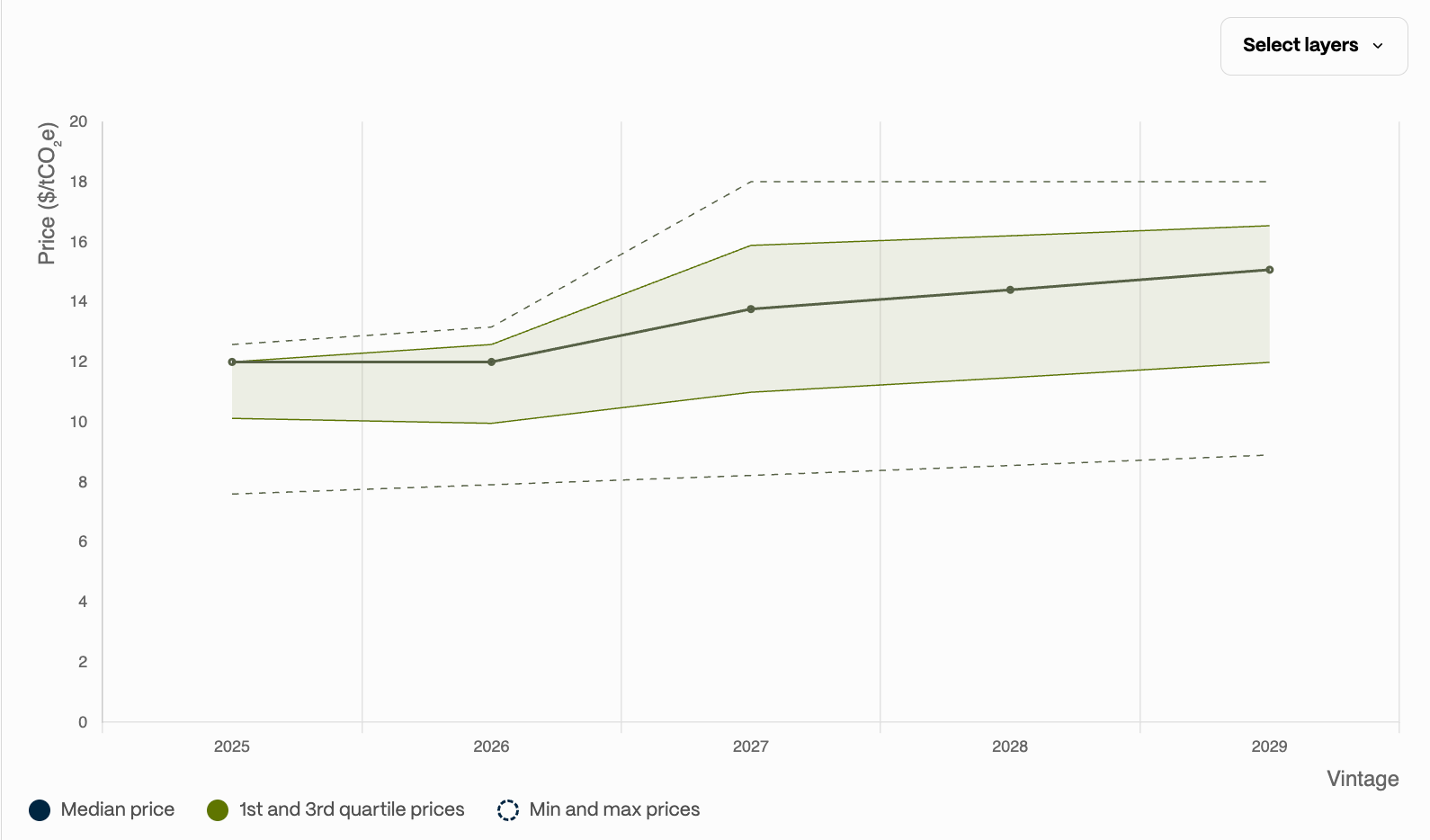

The market is already showing signs of adjustment. REDD+ carbon credits under older vintages trade at $2–6, while newer, high-integrity credits are tracking in the $10–16 range (see Figures 5 and 6). ART-credited projects, favoured in compliance schemes like CORSIA, are reaching $20+, suggesting buyers will pay more when quality is proven.

REDD+ carbon credit forward curves seem to suggest a structural re-pricing of old versus new methodologies

Figure 5. Historical spot prices of transactions or offers in the VCM for REDD+ (Last 24 months). Source: Abatable pricing dataset, as of Q1 2025

Forward prices of transactions and offers in the VCM for future REDD+ vintages and delivery

Figure 6. Source: Abatable pricing dataset, as of Q1 2025

VM0048 is a necessary step for the market. It represents a fundamental shift to conservatism and directly answers broader market concerns about REDD+.

Prices are expected to rise under VM0048 as a result of the methodology being considered high integrity. This is furthered by the methodology receiving a CCP label, reinforcing its credibility and boosting buyer confidence. However, if market price increases are insufficient, this may place the future of some REDD+ projects at risk and result in a widespread rearrangement of the REDD+ landscape.

Ultimately, carbon credit buyers must be willing to pay significantly more than current levels to enable the REDD+ landscape as it is to remain viable. When compared to the prices of other forestry types under similar, high-quality Verra methodologies, which are more capital and time-intensive, it currently looks uncertain if REDD+ will achieve the required values for all projects to survive.

REDD+ may evolve in several ways:

- Project geography may shift to regions with higher deforestation risk, based on Verra’s risk mapping.

- Smaller, community-led projects may gain prominence due to lower capital intensity and greater ESG value – but will require robust consent and governance processes.

- Blended finance – through philanthropy, debt-for-nature swaps, or concessional capital – may become essential to support less commercially viable projects.

- Integration with ARR (Afforestation, Reforestation, and Revegetation) could offer hybrid models, with REDD+ serving as an early revenue source while ARR matures.

We could also see more geographically diverse REDD+ development, especially in regions where the cost of implementation is lower – but only if jurisdictional risk maps are made available.

Conclusions

VM0048 provides a much-needed shift towards integrity, but it comes at a cost. For REDD+ to stay viable under this new methodology, credit buyers must expect to see prices rise to several times their current value – to a level of at least $15.

Whether buyers are willing to pay these prices remains to be seen. This, combined with many jurisdictions still awaiting risk mapping publication, leaves project developers in a state of limbo.

Time will tell whether REDD+ finds redemption in the market.

Access the full analysis in the Abatable platform.

Abatable has also modelled the new floor price for high-quality cookstove credits – read the findings here.

Find out more about Abatable’s high-integrity carbon credit sourcing solutions here.

Acknowledgements

We would like to thank the REDD+ project developers and members of the United Nations Environment Programme who provided valuable feedback on this work.

Disclaimer: This communication is provided for information purposes only, is subject to change without notice and is not binding. Any prices or quotations in the information provided are indicative only, are subject to change without notice and may not be used or relied on for any purpose, including valuation purposes. This communication is not a solicitation to buy or sell any product, or to engage in, or refrain from engaging in, any transaction. Nor does it constitute investment research, a research report or a personal or other recommendation. Nothing in the information provided should be construed as legal, financial, accounting, tax or other advice. Abatable does not accept any responsibility or liability (in negligence or otherwise) for loss or damage resulting from the use of or relating to any error in the information provided. This information has been prepared in good faith and is based on information obtained from sources believed to be reliable, however, Abatable is not responsible for information stated to be obtained from third-party sources. Any modelling, scenario analysis, past or simulated past performance (including back-testing) contained in this information is no indication as to future performance.

© Zero Imprint Limited (Abatable) | 2025