New analysis from Abatable finds that the minimum floor price for carbon credits from high-quality cookstove projects is at least $15 – rising to $39 for higher-integrity solutions. As Coco Chernel writes, carbon credit buyers should move away from existing, outdated price benchmarks for cookstove carbon credits to support the new era for high-quality carbon emission avoidance.

The voluntary carbon market (VCM) has experienced a push toward greater integrity in recent years, particularly in the cookstoves and REDD+ sectors, where new methodologies, monitoring procedures and technologies are providing better assurance of genuine climate impact.

These developments – while welcome – also drive up implementation costs for carbon credit projects, the implications of which have not been fully assessed.

In a new analysis, Abatable has analysed the cost of delivering high-quality cookstove avoidance credits in the new carbon credit supply landscape. We find that carbon credit buyers should expect to pay a minimum price of $15 for high-quality cookstove credits, rising to $39 for higher-integrity solutions.

New standards impacting supply

New crediting methodologies, more advanced stove technologies, and better monitoring have raised standards in the cookstoves sector but also costs for project developers. While these developments improve credibility and genuine climate impact, they also shrink issuance volumes and increase project expenses.

To date, evaluation of the financial implications for cookstove project development as a result of these new standards has been limited. Abatable has therefore conducted a simplified financial analysis of different cookstove project scenarios, modelling how various design choices can influence overall project development costs.

Our findings show the true cost of delivering high-impact, high-integrity cookstove credits in today’s voluntary carbon market (VCM). They reveal that cookstove project development costs are significantly higher than current market spot prices, and demonstrate that carbon credit buyers should move away from existing, outdated price benchmarks.

Methodology

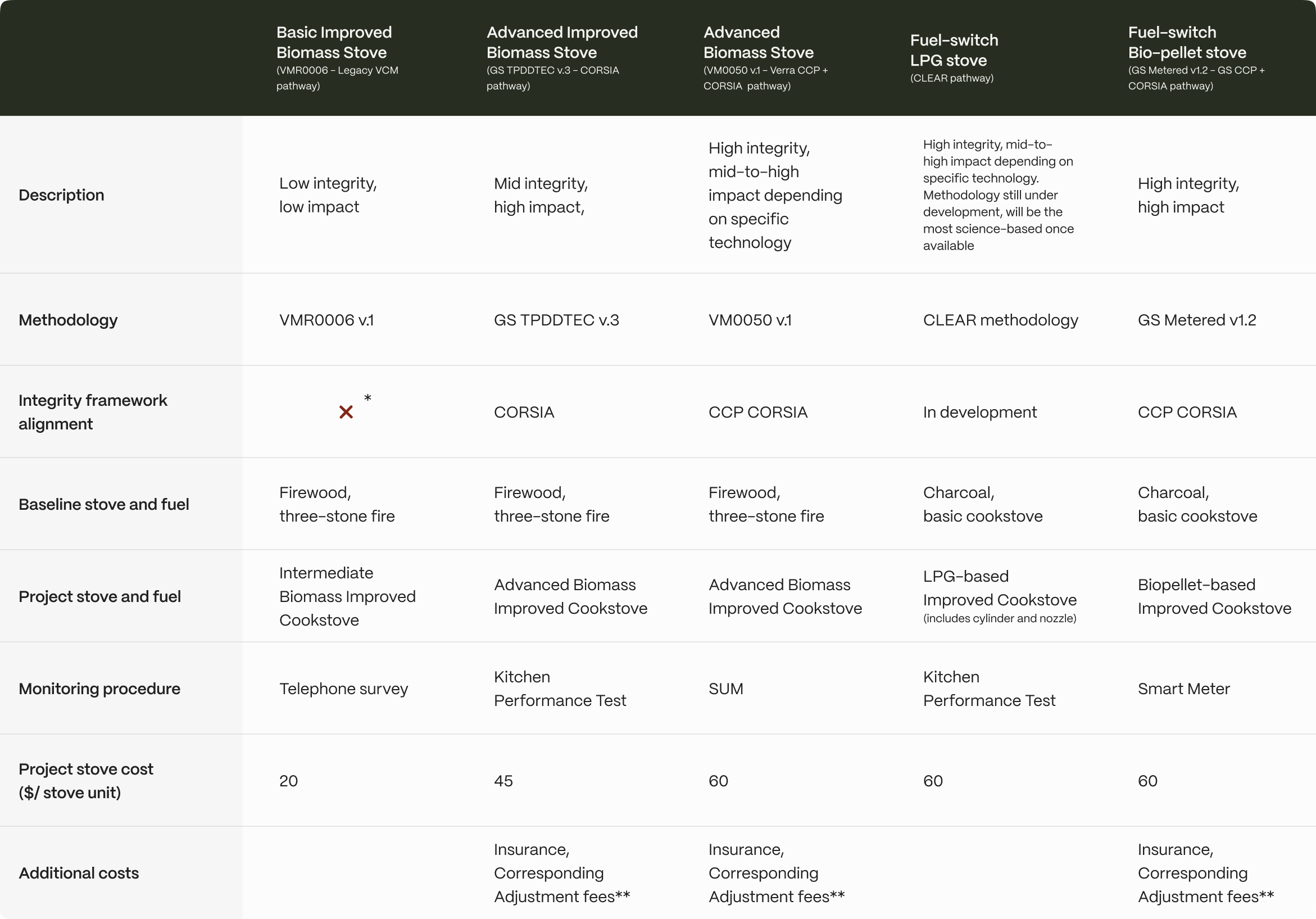

Abatable analysed five distinct cookstove project scenarios (see Table 1) using a consistent five-year crediting period and a Kenya-based setting. The scenarios reflect legacy, current and emerging pathways, with various combinations of stove technology, methodology, fuel types, and monitoring rigour.

We modelled three degrees of conservatism in terms of key emission parameters (e.g. fuel-switch efficiency, fNRB, usage rates, and emissions factors):

- Most conservative: strictest possible assumptions.

- Realistic: representative of current project norms.

- Least conservative: minimum compliance with methodology.

As such, each scenario, and the integrity and impact labels assigned, should be considered as the combined effect of the stove, methodology, conservatism, and MRV used.

Abatable’s cost model includes the manufacturing and distribution of stoves, which vary based on the stove type, and ongoing monitoring costs, adjusted to the specific MRV procedure. For ease, project registration costs are fixed. All cost assumptions were validated by cookstove project developers.

Table 1. Summary of key cookstove scenarios modelled in Abatable’s financial analysis (Source: Abatable, as of April 2025). *Methodology was withdrawn by Verra and rejected for eligibility under the IC-VCM and CORSIA. **Insurance coverage is necessary under Verra and Gold Standard for compliance with the CORSIA scheme; insurance costs may vary by policy or product offered. Corresponding Adjustment fees may apply per country. However, both have conservatively been excluded from development costs, given the high regional variability and uncertainty.

Key findings

1. Fewer credits, higher cost per tonne.

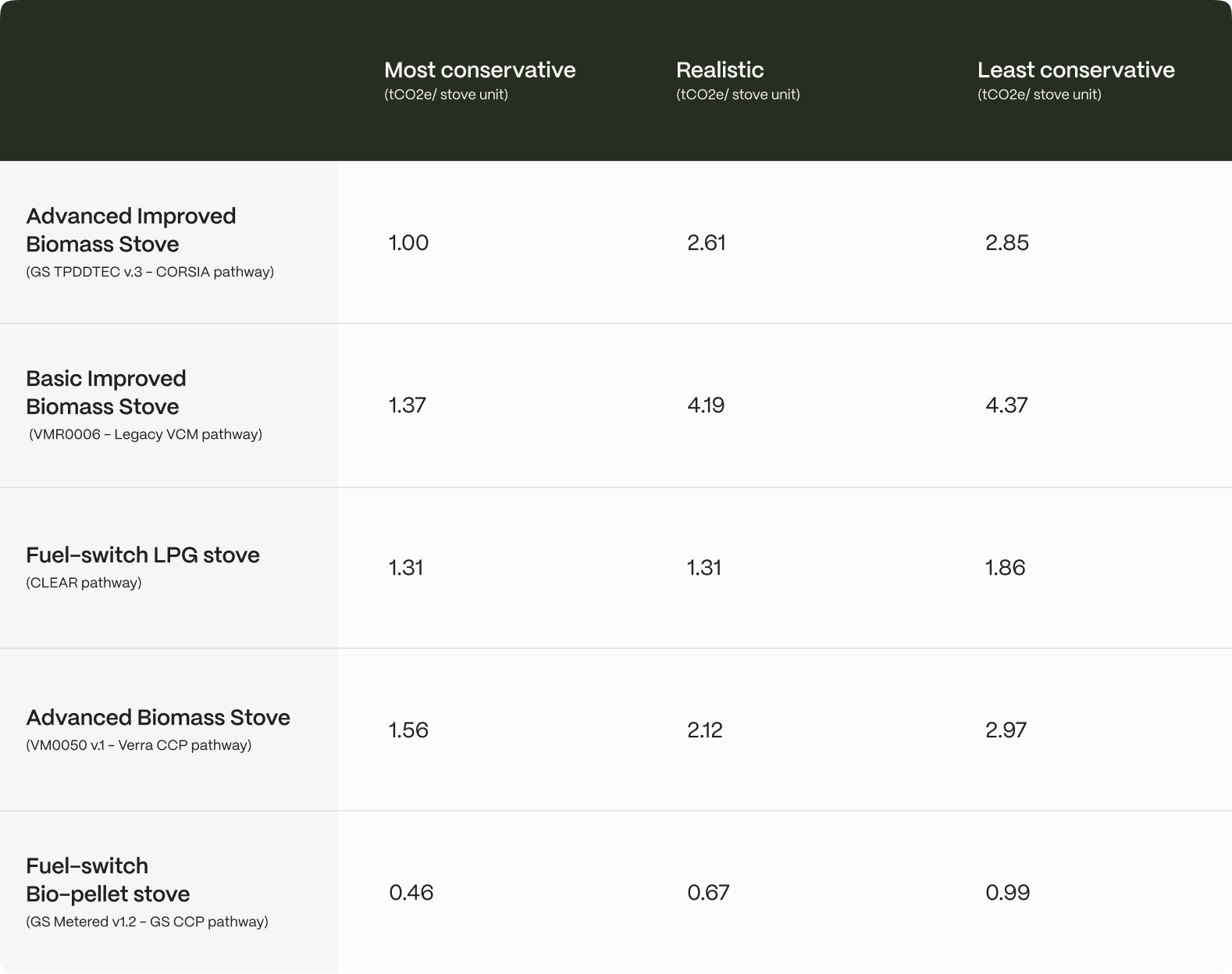

Table 2 summarises the range of emission reductions achieved per stove across all scenarios of conservatism. Our results show that whilst flexible, modern cookstove methodologies tend to be more conservative in the carbon model, generating fewer emission reductions (credits) overall. Thus, with fewer credits available for sale, cookstove carbon projects face lower revenue potential at existing market prices, unless each credit sells for more.

Table 2. Summary of emission reductions generated per stove unit for a given year across key cookstove scenarios in Abatable’s financial analysis. (Source: Abatable, as of April 2025)

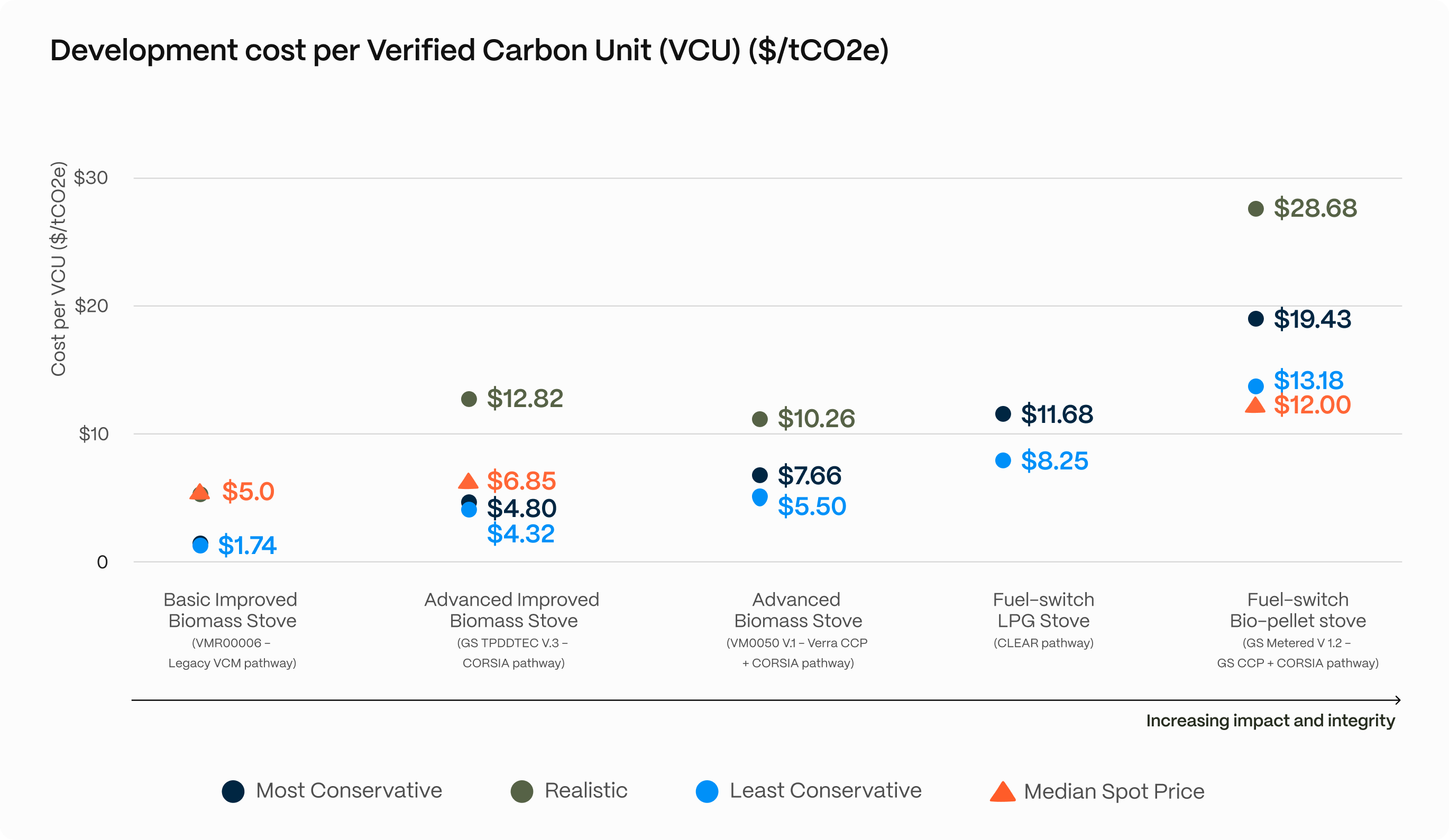

2. Higher-impact projects have increased development costs.

Advanced stoves cost more to manufacture and distribute, especially when accessories like smart meters or LPG components are included. This cost is borne by the carbon project(s) acting as credit supplier(s).

Monitoring of project impacts has become more rigorous, shifting from surveys to direct fuel-use assessments and smart meters, improving quality but raising costs. Figure 1 displays our most conservative, realistic and least conservative model outputs for each scenario modelled compared to prices seen in the spot market today.

Figure 1. Development costs for a single verified carbon unit or credit generated across all scenarios in Abatable’s financial analysis, compared to spot prices in the market today. The median spot price is sourced from Abatable’s carbon credit pricing dataset. (Source: Abatable, as of April 2025). Given that no projects have yet transacted under the Clear Methodology or VM0050, no median spot price is provided.

3. A pricing gap that needs closing.

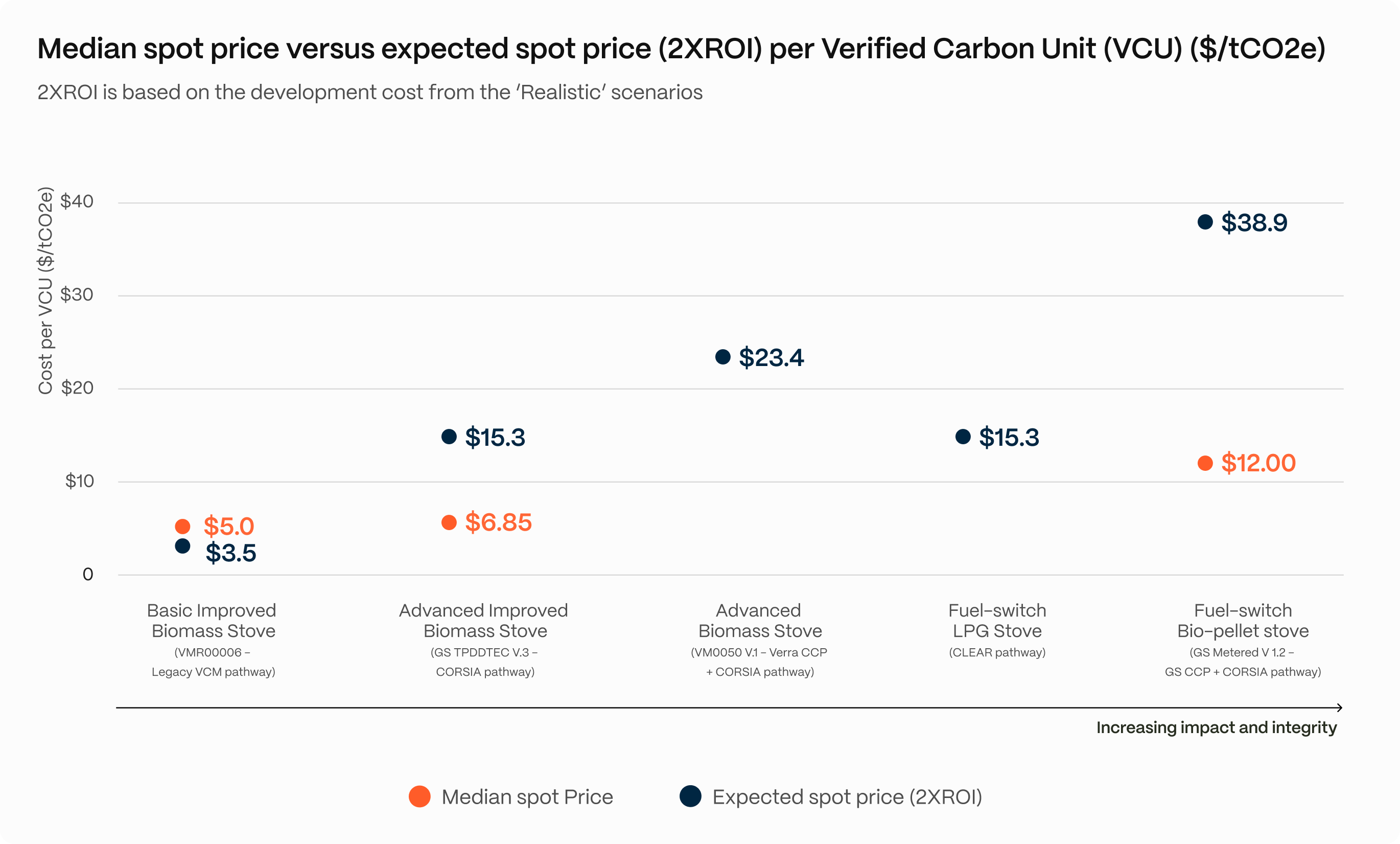

Our model finds a significant disconnect between the current median spot price for cookstove projects and the expected spot price we would expect to see for a high-impact project. As Figure 2 outlines, we expect the minimum floor price for high-quality cookstove credits to be $15.30, rising to $38.90 for higher-integrity solutions.

For more context, read the full analysis.

Figure 2. Price benchmarks for cookstove projects in Abatable’s financial analysis. Median spot price is sourced from Abatable’s carbon credit pricing dataset. (Source: Abatable, as of April 2025)

Why prices must rise

At current prices, high-integrity cookstove projects can’t attract the investment needed to scale. Our expected spot price (2xROI) – or twice the development cost under the Realistic version of each scenario – reflects the level typically required for project bankability. Only by reaching these price points will developers move toward better technologies and standards.

For instance:

- Projects using smart meters and clean fuels may need $39 per tonne or higher to break even.

- Under CORSIA and Article 6 pathways developers may also face insurance and Corresponding Adjustment (CA) fees, pushing costs higher still.

The case for buyer and investor action

To support climate and health outcomes, carbon credit buyers should recognise the true value of these credits. Better stoves reduce emissions, improve air quality, and reduce reliance on unsustainable fuels. This has profound impacts on household health, gender equality, and forest preservation.

Benchmarking by credit type is no longer enough. Buyers should assess:

- Methodology used;

- Conservatism;

- Monitoring rigour;

- Stove type and fuel; and

- Alignment with integrity frameworks.

Cookstove projects are capital-intensive up front, with costs concentrated in stove manufacturing, distribution, and validation. Early-stage finance and structured offtake agreements are now more important than ever to help developers deliver high-quality solutions.

This is a pivotal moment for the cookstoves sector. As methodologies improve, the market must reflect the true cost of integrity. The risk is clear: without sufficient price support, high-impact cookstove projects will stall, leaving only low-cost, low-integrity options behind.

It’s not just up to buyers. Standards, brokers, and platforms should be transparent about what high quality entails and help educate the market.

Collective understanding is key to scaling the new era of credible climate action.

Access the full analysis in the Abatable platform.

Abatable has also modelled the new floor price for high-quality REDD+ credits – read the findings here.

Find out more about Abatable’s high-integrity carbon credit sourcing solutions here.

Acknowledgements

We would like to thank the Clean Cooking Alliance, BURN, Howden and Oka for their valuable contributions and feedback on this work.

Disclaimer: This communication is provided for information purposes only, is subject to change without notice and is not binding. Any prices or quotations in the information provided are indicative only, are subject to change without notice and may not be used or relied on for any purpose, including valuation purposes. This communication is not a solicitation to buy or sell any product, or to engage in, or refrain from engaging in, any transaction. Nor does it constitute investment research, a research report or a personal or other recommendation. Nothing in the information provided should be construed as legal, financial, accounting, tax or other advice. Abatable does not accept any responsibility or liability (in negligence or otherwise) for loss or damage resulting from the use of or relating to any error in the information provided. This information has been prepared in good faith and is based on information obtained from sources believed to be reliable, however, Abatable is not responsible for information stated to be obtained from third-party sources. Any modelling, scenario analysis, past or simulated past performance (including back-testing) contained in this information is no indication as to future performance.

© Zero Imprint Limited (Abatable) | 2025